- Aviva, Legal & General, and More2Life are the top-rated equity release providers in the UK - these companies consistently lead in product flexibility, customer satisfaction, and plan innovation. More2Life stands out for enhanced borrowing based on health conditions, while Aviva and Legal & General offer both drawdown and lump-sum lifetime mortgages.

- The right provider depends on interest rates, flexibility, and regulatory protection - average interest rates in 2025 are around 6.9%, with the lowest nearing 6.07% depending on provider and plan type1. Choosing a provider regulated by the FCA and a member of the Equity Release Council ensures added consumer safeguards.

- Equity release lending is rising, but drawdown flexibility is becoming essential - in Q2 2025, UK homeowners unlocked £636 million across 14,404 new equity release plans2. Over half chose drawdown products, reflecting growing demand for staged access to funds rather than large lump sums.

The demand for equity release in the UK is growing rapidly, with more homeowners aged 55 and over unlocking property wealth to supplement retirement income, fund home improvements, or support family.

As the number of providers and plan options expands, identifying a reliable and competitive lender has become more important than ever.

In This Article, You Will Discover:

This guide breaks down the top equity release companies in 2026, comparing them based on interest rates, plan flexibility, customer satisfaction, and regulatory standards.

Whether you're just starting your research or ready to choose a provider, this article offers the insights you need to make an informed, confident decision.

Read on to discover the key players and top tips...

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Best Equity Release Companies in the UK

As equity release lending continues to grow in the UK, a select group of providers consistently excel in flexibility, borrowing capacity, and customer satisfaction.

These five firms led the market in 2025 and are top-rated by both the Equity Release Council and independent reviewers.

1. Aviva

Aviva is one of the most established lifetime mortgage providers in the UK.

It offers both lump‑sum and drawdown loans, voluntary repayment options, inheritance guarantees, and a no negative equity promise.

Early 2025 data from Atmosphere shows that Aviva’s lifetime mortgage sales rose sharply, contributing significantly to the £636 million total released in Q2 20253.

Learn More: Aviva Equity Release

2. Legal & General

Legal & General is known for its broad product range, including interest‑serviced lifetime mortgages that allow interest payments up to a specified age, after which interest accumulates.

L&G has issued billions in equity release funding and frequently wins industry awards for product innovation and customer service4.

Learn More: Legal & General Equity Release

3. More2Life

More2Life specialises in medically enhanced lifetime mortgages.

It offers greater borrowing capacity or reduced rates for those with health conditions, alongside flexible drawdown and slow-roll options.

Recognised repeatedly in financial awards, it remains a top choice for applicants seeking tailored terms.

Learn More: More2Life Equity Release

4. Pure Retirement

Pure Retirement is praised for offering consistently competitive interest rates and flexible features such as drawdown options and downsizing protection.

Its Sovereign and Heritage product lines are widely recommended by advisers for those seeking modern, flexible lifetime mortgages5.

Learn More: Pure Retirement Equity Release

5. Canada Life

Canada Life (formerly Retirement Advantage) introduced enhanced features such as voluntary repayment structures and guaranteed inheritance options.

It also supports flexible cash reserve options, making it especially appealing to borrowers who want control and predictability.

Learn More: Canada Life Equity Release

Why These Providers Stand Out

| Criteria | Why These Providers Excel |

|---|---|

| Regulation & Governance | All five are regulated by the FCA and members of the Equity Release Council ensuring consumer protection. |

| Plan Flexibility | They offer multiple products, lump sum, drawdown, interest-serviced and repayment options. |

| Customer Trust & Awards | Consistently rated highly in customer satisfaction surveys and industry comparisons. |

| Competitive Rate Access | Providers like Aviva and Pure Retirement are often matched to the market’s lowest rates (as low as 6.07% MER in May 2025)6. |

| Tailored Lending Features | More2Life and Canada Life offer health-based enhancements and inheritance guarantees for homeowner confidence. |

Other Top Equity Release Providers in 2025

Beyond the leading five providers, several other companies remain active and trusted in the equity release market.

While these firms may not have the highest volume of lending, they offer specialist products, adviser-led services, or consumer protections that appeal to specific borrower profiles.

Just (Just Retirement)

Just continues to offer a range of equity release plans, including drawdown and lump-sum lifetime mortgages.

Its products are available through independent financial advisers and often include enhanced terms based on medical conditions.

Fixed early repayment charges, inheritance protection options, and strong regulatory credentials make Just a popular choice for applicants who want structured, adviser-led support.

Learn More: Just Equity Release

Saga (via Hub Financial Solutions)

Saga provides equity release access through a partnership with Hub Financial Solutions.

This advisory-led service targets homeowners aged 55 and over, offering access to a panel of ERC-approved providers.

Features include a six-month refund policy on advice fees, flexible plan types, and a no negative equity guarantee.

Saga’s model is ideal for customers who want guided advice within a trusted consumer brand.

Learn More: Saga Equity Release

LV= (Liverpool Victoria)

LV= offers lump-sum and drawdown lifetime mortgages with a focus on transparency and flexibility.

The company provides voluntary repayment options, inheritance protection features, and competitive interest rates.

All plans are distributed through FCA-regulated financial advisers and meet Equity Release Council standards.

Royal London

Royal London offers lifetime mortgage products through its later-life lending partnerships and adviser distribution networks.

Its plans typically include fixed interest rates, flexible repayment terms, and protection features such as no negative equity guarantees.

Royal London’s long-standing reputation and cautious underwriting make it a good fit for risk-averse borrowers.

Learn More: Royal London Equity Release

Scottish Widows (Standard Life-branded mortgages)

Scottish Widows distributes equity release products under the Standard Life brand, offering both drawdown and interest-serviced lifetime mortgages.

The products are structured to suit homeowners who want to retain flexibility or manage inheritance planning.

Available via regulated advisers, these plans offer competitive rates and are backed by strong institutional reliability.

Learn More: Scottish Window Equity Release

Why These Providers Are Worth Considering

| Provider | Strengths |

|---|---|

| Just | Adviser-led model, enhanced borrowing based on medical conditions |

| Saga | Trusted brand with strong consumer support and advice-first service model |

| LV= | Transparent pricing, voluntary repayments, and flexible product terms |

| Royal London | Strong brand trust and conservative approach to later-life lending |

| Scottish Widows | Flexible product structures and access via established adviser networks |

These providers add meaningful choice for borrowers who prioritise flexibility, brand trust, or access to specialist advice.

How We Rated Equity Release Companies

To determine the best equity release providers in the UK, we used a structured evaluation model grounded in industry data, regulatory standards, and user-focused benchmarks.

Each company was assessed using the following seven criteria:

- Market Share

We reviewed the latest lending volumes published by the Equity Release Council and third-party market analysts to identify providers with a significant presence in the UK later-life lending sector. - Customer Reviews

Independent ratings from platforms such as Trustpilot and Feefo were analysed to gauge customer satisfaction, adviser support, and service consistency across the product lifecycle. - Interest Rates and Fees

We compared advertised and average interest rates across lump-sum and drawdown plans, along with early repayment charges, advice fees, and legal costs to assess overall affordability. - Product Flexibility

Providers were evaluated based on their range of plan types, including voluntary repayment options, drawdown flexibility, downsizing protection, and inheritance guarantee availability. - Financial Strength

We considered the provider’s credit rating (where available), group ownership structure, and operational history to assess long-term reliability. - Regulatory Compliance

Only lenders regulated by the Financial Conduct Authority (FCA) and members of the Equity Release Council (ERC) were included to ensure consumer protection standards were met. - Innovation and Support

We reviewed whether providers offer enhanced products for health conditions, digital application tools, or adviser support models that improve transparency and usability.

This methodology ensures that rankings are based not just on marketing claims, but on meaningful, measurable indicators of trust, value, and product performance.

Equity Release Alternatives & Providers

Equity release is not the only way to access home equity.

Several alternatives may better suit certain homeowners, particularly those who can afford monthly payments or plan to move.

Below are three primary alternatives supported by leading UK financial providers.

1. Retirement Interest‑Only (RIO) Mortgages

These allow homeowners aged 55+ to borrow against their property and make monthly interest payments, without repaying the capital until the home is sold (e.g. on death or move into care).

RIOs are not equity release products, but are often recommended alternatives.

Providers include:

- Barclays, offering fixed-rate RIO mortgages (currently around 4.89% APRC), with no product fees and up to 65% LTV. Includes fee-free home valuations and flexible payment holidays7.

- Nationwide Building Society, with variable and fixed RIO offers and rates starting from approximately 4.70% APRC for over‑60 borrowers, supporting LTVs up to 50%8.

RIO mortgages can be more cost-effective in the long term if borrowers can reliably pay monthly interest and avoid the compound growth of unrepaid loans.

2. Downsizing

Selling a larger home and purchasing a smaller one is another way to unlock property equity without taking on debt.

- A typical downsizer in the UK unlocks around £134,405, compared with an average of £115,000 from equity release9.

- Common real estate agents for downsizing include Purplebricks, Rightmove, and Savills.

Downsizing avoids accruing debt, reduces or eliminates home-related expenses, and can improve lifestyle options.

However, costs such as stamp duty, estate agency fees, and emotional considerations must be included in the decision.

3. Pension Drawdown

For individuals with defined contribution pensions, pension drawdown offers an alternative way to access funds flexibly while keeping the pension invested.

- Providers include Hargreaves Lansdown, AJ Bell, and Standard Life, offering varying models of income withdrawal with tax implications and investment risk to consider.

Pension drawdown works well for retirees seeking controlled access to savings potentially with lower long-term cost than equity release.

It can impact entitlement to certain state benefits and has tax considerations.

When to Consider Each Alternative

| Alternative | Best For |

|---|---|

| RIO Mortgage | Those confident in regular interest payments and who want to avoid compounding debt. |

| Downsizing | Homeowners open to moving and needing a lump sum without taking on new debt. |

| Pension Drawdown | Retirees with substantial pension assets who want controlled, tax-efficient access to funds. |

Each alternative carries different advantages and risks.

RIO mortgages eliminate compound debt growth but require reliable income.

Downsizing avoids debt but involves move-related costs and lifestyle changes.

Pension drawdown enables flexibility but may reduce inheritance and affect benefits.

Seeking independent, FCA-regulated financial advice ensures the chosen path aligns with your long-term financial goals.

Equity Release Legal Advice & Solicitors

Equity release transactions involve legal and regulatory risks that must be carefully managed.

A qualified solicitor plays a critical role in protecting the homeowner’s rights, ensuring regulatory compliance, and completing the process efficiently.

What Do Equity Release Solicitors Do?

Solicitors handling equity release must be independent of the adviser or lender, and their duties include:

- Providing Independent Legal Advice

Solicitors must confirm that the homeowner fully understands the long-term financial implications, including compound interest, inheritance impact, and repayment conditions. - Reviewing Legal Documents

They check the mortgage offer, terms and conditions, and repayment clauses to ensure fairness and legal transparency. - Conducting Regulatory Checks

The solicitor ensures the lender is authorised by the Financial Conduct Authority (FCA) and a member of the Equity Release Council (ERC), which guarantees safeguards such as the no negative equity guarantee. - Finalising the Transaction

Once the borrower signs, the solicitor manages fund release, confirms the legal charge on the property, and ensures all compliance documentation is properly lodged.

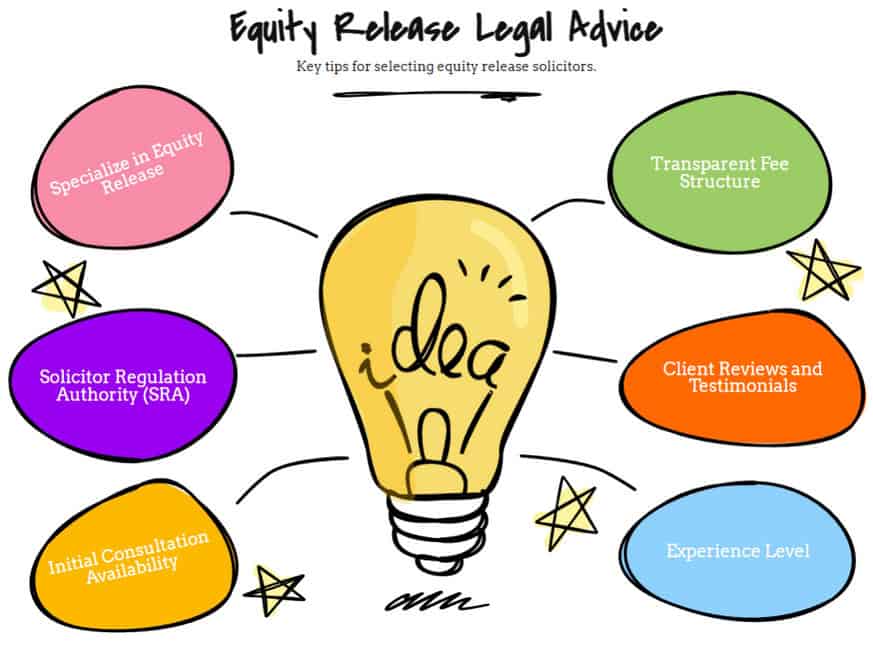

What Makes a Solicitor Suitable for Equity Release?

Not all solicitors specialise in later-life lending. Look for legal professionals who:

- Are experienced in equity release and lifetime mortgages specifically

- Are regulated by the Solicitors Regulation Authority (SRA)

- Belong to the Equity Release Council’s list of approved legal firms

How to Find a Reputable Equity Release Solicitor

- Use the Law Society’s “Find a Solicitor” tool to verify specialisation and regulatory status

- Ask your financial adviser for solicitor options, but ensure they are independent of the product provider

- Read verified customer reviews and check that the solicitor offers a transparent fee structure before instruction

Using a specialist solicitor is essential to protect your legal interests and ensure a compliant, stress-free equity release process.

They provide legal clarity, prevent missteps, and act as your final safeguard before funds are released.

Trusted Equity Release Resources & Tools

Making an informed equity release decision requires access to expert-led, independent resources. The platforms and tools below provide regulated guidance, impartial advice, and market comparisons.

Authoritative Information Sources

- Equity Release Council (ERC)

The official trade body for equity release in the UK. Provides a list of approved lenders and advisers, industry standards, and consumer protections, including the no negative equity guarantee. - MoneyHelper (formerly Money Advice Service)

Government-backed platform offering free, impartial guidance on later-life lending, including pros and cons of equity release, tax implications, and alternatives. - FCA (Financial Conduct Authority)

The UK regulator for financial services. Use the FCA register to check whether an equity release adviser or lender is authorised to operate. - Which?

An independent consumer organisation offering product reviews, provider comparisons, and practical guides on equity release and retirement planning. - Age UK

Offers detailed information on how equity release can affect means-tested benefits, inheritance, and care planning for older homeowners. - The Telegraph & The Guardian

Leading UK newspapers that frequently publish industry updates, expert commentary, and rate comparisons for equity release products.

Tools for Informed Decision-Making

Equity Release Calculators

Most providers and comparison websites offer online calculators. These allow homeowners to estimate how much equity they could unlock based on age, property value, and mortgage type.

While useful for initial planning, results are indicative and must be confirmed through regulated advice.

Rates & Fees Overview

Equity release products generally have higher interest rates than standard residential mortgages, with average rates in 2025 ranging between 6.07% and 6.95% MER, depending on product type and borrower profile.

Costs may include:

- Product setup fees

- Legal and valuation fees

- Adviser fees (if applicable)

- Early repayment charges (variable by provider)

Some lenders offer fee-free deals or cashback incentives, particularly on drawdown plans.

Always compare total cost of borrowing, not just advertised rates.

Common Questions

How Accurate Are Equity Release Calculators and What Do They Show?

What Fees and Charges Should I Expect With Equity Release?

What Are the Main Alternatives to Equity Release, and How Do They Compare?

Can I Repay an Equity Release Plan Early Without Penalty?

Will Equity Release Affect My Entitlement to Means-Tested Benefits?

What Happens to My Equity Release Plan When I Die or Move Into Care?

Can I Move Home After Taking Out an Equity Release Plan?

Do I Need to Involve My Family in the Decision?

In Conclusion

Choosing the right equity release provider is a significant financial decision that should be made with clarity, guidance, and trusted information.

By understanding your options, comparing plan features, and seeking independent legal and financial advice, you can secure a solution that fits both your current needs and long-term goals.

Whether you're considering equity release to supplement retirement income, support family, or manage future care costs, taking a structured and well-informed approach is the best way to protect your financial wellbeing and make the most of your property wealth.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.