- To secure the best equity release deals, compare offers from various providers using comparison websites and seek advice from a financial adviser who can provide insights into exclusive deals and market conditions.

- Consider important factors when comparing options, such as interest rates, withdrawal flexibility, upfront and ongoing fees, lender reputation, and seasonal promotions and special offers.

- Use comparison tools to evaluate different plans, be cautious of potential pitfalls like early repayment charges and plan flexibility, and always verify that the Equity Release Council approves the deal to ensure safety and regulatory compliance.

Did you know that over 100,000 homeowners in the UK are expected to release equity from their properties in 2026? Finding the best equity release deals can feel overwhelming, especially with the variety of plans available and the constantly changing market.

But don’t worry—our expert BankingTimes guide is here to make the process simple and stress-free.

Whether you’re looking to release cash from your home for retirement, home improvements, or just to ease financial pressures, we’ll help you identify the top deals and secure the best rates.

Let’s dive into the best options in 2026 and ensure you don’t miss out on these offers...

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What is Equity Release?

Equity release is a financial arrangement designed for homeowners, typically aged 55 and older, allowing them to access the value (equity) tied up in their property.

There are different types of equity release schemes, with the 2 main options being lifetime mortgages and home reversion plans.

How Do Equity Release Interest Rates and Fees Compare?

Equity release interest rates and fees can vary significantly between providers and plans, with rates typically ranging from 5% to 6% in 2026.

It's essential to compare both the interest rates and any additional fees, such as arrangement or exit fees, as they can greatly impact the overall cost of your equity release plan.

View some of the current equity release interest rates and fees below:

| Provider | Scheme Name | Monthly (Rate) The amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. |

|---|---|---|

| Pure Retirement | Age Partnership Classic Flexible Lump Sum 1 | 5.97% |

| Canada Life | Age Partnership Ultra Lite Fixed ERC | 6.13% |

| Canada Life | Capital Select Ultra Lite Fixed ERC | 6.16% |

| Aviva | Age Partnership Lifestyle Flexible Option, Fixed ERC | N/A |

| Canada Life | Age Partnership Ultra Lite Plus Fixed ERC | 6.20% |

| Canada Life | Capital Select Ultra Lite Plus Fixed ERC | 6.24% |

| Just Retirement | Age Partnership J1 Lump Sum (>25% Payments) Fixed ERC (Enhanced) | 6.25% |

| Just Retirement | Age Partnership J1 Lump Sum (>25% Payments) Fixed ERC (Enhanced) | 6.25% |

| Canada Life | Age Partnership Super Lite Fixed ERC | 6.27% |

| Just Retirement | Age Partnership J2 Lump Sum (>25% Payments) Fixed ERC (Enhanced) | 6.28% |

Updated: 18/02/2025

What Are the Best Equity Release Deals in the UK?

The best equity release deals in the UK vary according to individual circumstances and prevailing market conditions; currently, some leading equity release providers include Legal & Genera, Aviva, and More2Life, all offering competitive interest rates and flexible terms.

It's crucial to remember that the best deal does not just hinge on interest rates, and factors such as early repayment charges, the flexibility to make partial repayments, and the inclusion of downsizing protection also play significant roles.

Therefore, a comprehensive comparison tailored to individual needs remains the most effective approach.

Where Can You Find the Best Deal?

You can find the best equity release deal by ensuring that you do not settle for the first option, but first look at comparison websites, consult financial advisers, speak directly to providers, read reviews and recommendations, consult a specialised broker, and look around for local offers in your area.

Here is a breakdown of these crucial steps:

Comparison Websites

Comparison websites and digital platforms, like Equity Release Supermarket1 and Compare Equity Release,2 are some of the first places to search for the best deals.

These sites have become a pivotal starting point by presenting a comprehensive overview of available deals, including detailed breakdowns of interest rates, flexible terms, and additional features.

Additionally, they often integrate user reviews and ratings, adding another dimension for you to assess the best value for your specific needs.

Financial Advisers

Engaging with seasoned financial advisers from respected institutions like CHN Financial Consultancy3 or Humboldt Financial4 can be a game-changer.

These companies provide holistic financial planning, advising on the ripple effects of equity release on estate planning, potential tax ramifications, and the long-term implications for beneficiaries.

Direct Providers

Initiating direct dialogues with leading equity release providers, such as Aviva or Legal & General, often reveals the depth and breadth of their offerings.

These interactions can lead to uncovering exclusive deals, incentives for direct customers, or even opportunities to customise equity release terms.

By building a direct relationship, homeowners can better understand the provider's customer service ethos and post-deal support mechanisms.

Reviews and Recommendations

In today's digital age, platforms like Trustpilot5 and niche property forums have become indispensable, highlighting the importance of reviews and recommendations.

They host vast arrays of reviews, offering insights into the nuances of various schemes.

By perusing these platforms, potential users can discern the strengths and weaknesses of deals, understand common issues, and gauge providers' responsiveness to customer concerns.

Specialised Brokers

Specialised brokers, especially those connected to renowned firms like Age Partnership or Bower Home Finance, have their fingers on the pulse of the property financial market.

Their extensive networks, combined with an in-depth understanding of market trends, position them uniquely to identify emerging deals, negotiate better terms, and advise on potential market shifts that could impact equity release conditions.

Local Offers

Regional financial institutions, such as the revered Nationwide Building Society6 and other specialised credit unions, often design equity release schemes and local offers while considering regional dynamics.

Their offerings will reflect local property market trends, economic conditions, or regional regulatory nuances, and engaging with them can lead to discovering deals that perfectly resonate with local homeowners' needs.

Factors to Consider When Looking for a Deal

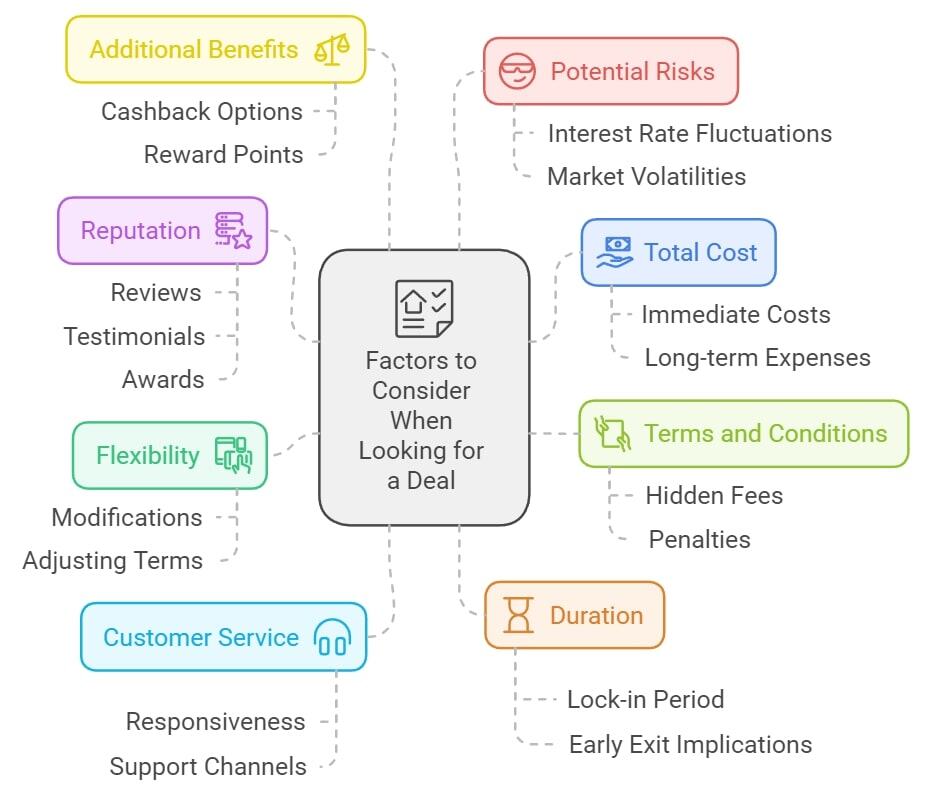

Factors to consider when looking for the best deal include the total cost, terms and conditions, reputation, flexibility, customer service, duration, additional benefits, and potential risks.

Delving deeper into each of these aspects can significantly influence the value and suitability of the deal concerning your specific needs and circumstances.

Consider these factors:

- Total Cost: It is essential to assess not just the immediate costs, such as upfront fees or initial interest rates, but also the cumulative expenses over the product's or service's lifespan, which can significantly impact the deal's overall value.

- Terms and Conditions: Thoroughly peruse the terms and conditions to unearth potential fees, penalties, or stipulations that might not be immediately evident but can affect the deal's feasibility.

- Reputation: The provider's standing in the market can be a telling indicator of their reliability. Delve into reviews, seek out testimonials, and take note of any industry awards or recognitions they have received.

- Flexibility: Life is unpredictable, and circumstances can change. Evaluate how accommodating the product or service is to modifications, altering terms, or adjusting features without incurring excessive penalties.

- Customer Service: Ascertain the provider's responsiveness, the availability of support channels, and the overall quality of their customer interactions.

- Duration: Gauge the lock-in period and seek clarity on the financial and logistical implications of making changes or exiting before the term concludes.

- Additional Benefits: Beyond the primary offering, some deals come augmented with added perks, such as cashback options, reward points, or complimentary services, enhancing the overall attractiveness of the deal.

- Potential Risks: Every deal has its associated risks. For financial offerings, it is imperative to consider variables like potential interest rate fluctuations or broader market volatilities that might impact the product's long-term viability.

How Did We Identify the Best Equity Release Deals?

We identified the best equity release deals by carefully evaluating key factors to find competitive products that meet homeowners' varied needs for accessing their home equity.

This approach facilitated the selection of equity release deals that offer safety, flexibility, and cost-effectiveness.

The factors we reviewed included:

- Interest rates

- Flexibility

- Loan-to-value ratios

- Fees and charges

- Product features

- Provider reputation

- Regulatory compliance

Common Questions

Why Should I Consider Speaking Directly to Equity Release Providers?

How Can I Determine the Flexibility of a Deal?

Are There Any Hidden Risks Associated With Deals on Equity Release?

Is There a Best Time of Year to Look for Equity Release?

Can I Switch Between Deals if I Find a Better Offer Later On?

What Are the Best Equity Release Deals in the UK?

How Can I Compare the Best Equity Release Deals?

Where Can I Find the Best Equity Release Deals?

Are There Any Risks Involved in the Best Equity Release Deals?

In Conclusion

Securing the best equity release deal can unlock incredible opportunities for homeowners, but finding the right deal requires diligence and thorough research.

With so many options available, always remember to weigh factors like interest rates, fees, and plan flexibility; additionally, seeking advice from a professional financial adviser or broker can ensure you make the most informed decision.

By using the resources provided and thoroughly assessing your personal needs and circumstances, you’ll be in a strong position to choose the best equity release company that aligns with your financial goals.

Don’t rush the process—your home’s value could be the key to a more secure future.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.