- Select a solicitor who is a member of the Equity Release Council, has a solid track record, and can be found through recommendations or legal directories—top choices include Irwin Mitchell, Shoosmiths, and Slater and Gordo.

- Legal advice ensures the transaction is handled correctly, the plan aligns with your financial situation, and you fully understand the terms.

- A solicitor should verify compliance with regulations, explain risks, and ensure the plan supports your financial goals.

When it comes to unlocking cash from your home, getting the best equity release solicitors to assist you along the way plays a crucial role—yet their importance is often overlooked.

For UK homeowners exploring ways to access their property's value, the process can quickly become a maze of legal and financial complexities; this is where expert solicitors step in, ensuring everything is legally sound while protecting you from potential pitfalls.

But why are they so vital? And how do you find the right one for your needs?

In this in-depth guide, we break down the key role of equity release solicitors, how they safeguard your interests, and what to look for when choosing the best legal professional for the job.

Let’s uncover everything you need to know for a safe, stress-free process...

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Are Equity Release Solicitors and Why Are They Crucial?

Equity release solicitors are legal professionals who specialise in the process of unlocking the value of a property1; these figures are crucial because they ensure that all legal work is carried out correctly, helping to safeguard homeowners from potential legal and financial risks.

Let's find out a little bit more about them:

What Is the Key Role of Solicitors in the Equity Release Process?

The key role of solicitors in the equity release process is to ensure that the transaction is legally sound and protects the interests of the homeowner.

They provide independent legal advice, explaining the terms or jargon and implications of equity release plans, including the financial and legal responsibilities involved.

The process involves these legal steps:

- Reviewing and advising on the plan to ensure it is in the homeowner's best interest.

- Conducting property valuations to determine its worth.

- Ensuring that the homeowner fully understands the implications of the agreement.

- Handling the legal documentation and formalities.

- Liaising with the provider and other parties involved in the process.

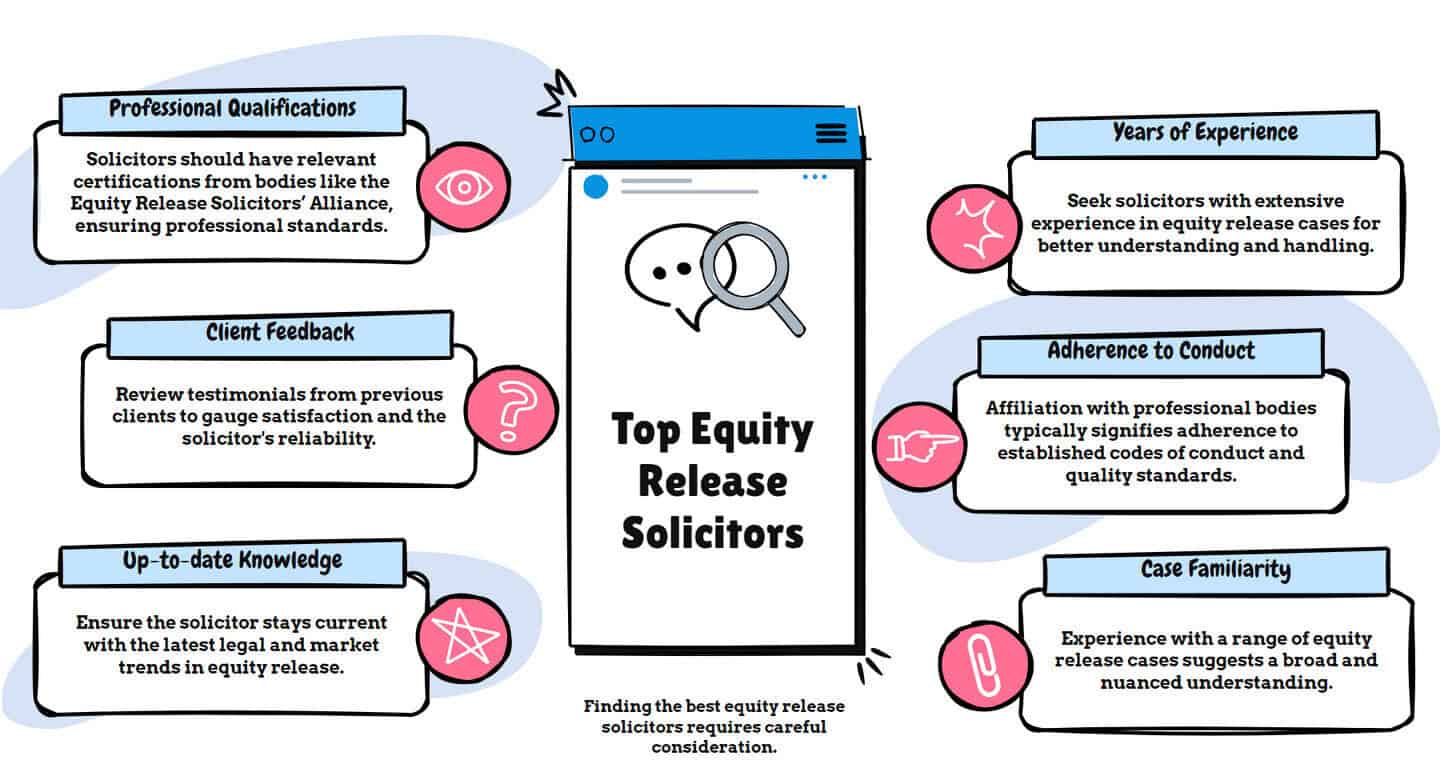

How to Identify the Best Equity Release Solicitors

To identify the best equity release solicitors, look for firms with specialist knowledge in later-life lending, ensure they are independent and offer impartial advice, and check that they are regulated by the Solicitors Regulation Authority (SRA) and adhere to ERC's standards.

Reviews, testimonials, and recommendations from trusted sources or financial advisers can guide you towards reputable firms with a proven track record in equity release.

Consider these important factors:

Importance of Professional Qualifications and Credentials

The importance of professional qualifications and credentials in the equity release process cannot be overstated, and solicitors with recognised qualifications, such as membership in the Equity Release Solicitors' Alliance (ERSA), demonstrate their adherence to ethical and professional standards.

These qualifications and memberships ensure that the solicitor has the necessary expertise and training to navigate the complexities of equity release, providing peace of mind that you are receiving trustworthy, informed, and legally compliant advice.

Assessing Experience and Expertise in the Field

Assessing experience and expertise in the equity release field ensures you receive reliable and knowledgeable advice, so look for solicitors who have a proven track record of handling equity release cases and a deep understanding of popular options lifetime mortgages and home reversion plans.

Firms with years of experience in the sector are likely to be familiar with the various products, regulations, and potential pitfalls.

Ultimately, when choosing a solicitor, consider the following:

- How many years have they been practising in equity release?

- What is the feedback from previous clients? Client testimonials can provide invaluable insights.

- Are they up-to-date with the latest legal and market developments?

Who Are the Best Equity Release Solicitors in the UK?

The best equity release solicitors in the UK are those with expertise in later-life lending and a strong reputation for consumer protection; firms such as Irwin Mitchell, Shoosmiths, and Slater and Gordo are well-regarded for their experience in handling equity release transactions efficiently.

In addition to adhering to Equity Release Council (ERC) standards, they have gained an esteemed reputation with their extensive experience, clear commitment to client confidentiality, and unerring focus on providing tailored advice for each unique case.

Special mentions include firms like Eversheds Sutherland and Ashfords LLP, which are acknowledged for their broad network of professionals that ensure a comprehensive understanding of the market and dedicated service to their clients.

Top 5 Equity Release Solicitors in the UK

The top 5 equity release solicitors include familiar names such as Smith and Associates Equity Release Solicitors, Elite Law Solicitors, and Harrison Legal Group.

Consider these firms for your solicitor needs:

- Smith and Associates Equity Release Solicitors: Comprehensive equity release legal advice, re-mortgage assistance, and more. At the time of writing, they have a 4.3-star rating out of 5 from 65 reviews on Google.2

- Harrison Legal Group: Provides legal solutions for equity release with advice tailored to individual needs, as well as property valuation services. With over 25 years of experience, Harrison has been a frontrunner in adapting to the evolving landscape.3

- Roger Brooker Solicitors: Systems structured to guarantee precision, with refined operational methods over numerous years, leveraging the latest technology at their disposal. Thanks to being a small, boutique firm, solutions are provided to fit a particular client’s situation rather than ‘product line’ solutions.

- Elite Law Solicitors: Full-spectrum legal support, including free initial consultations and a 24/7 helpline. They offer fixed fee quotes that are only adjusted if the lender's requirements alter during the process or if unexpected events cause delays beyond the anticipated timeline.4

- Bird and Co Solicitors: Their services encompass managing the full process, which includes advising on different release types, collaborating with lenders, reviewing contractual terms, completing legal documentation, and liaising with HM Land Registry.

*These figures may have shifted since our review.

Interest Rates and Fees Comparison

When comparing interest rates and fees for equity release, always assess both the cost of borrowing and any additional charges that could impact the total amount to be repaid.

Interest rates for lifetime mortgages generally range from fixed to variable, with fixed rates offering stability but sometimes at a higher cost.

View the current equity release interest rates and fees below:

| Provider | Scheme Name | Monthly (Rate) The amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed. |

|---|---|---|

| Pure Retirement | Age Partnership Classic Flexible Lump Sum 1 | 5.97% |

| Canada Life | Age Partnership Ultra Lite Fixed ERC | 6.13% |

| Canada Life | Capital Select Ultra Lite Fixed ERC | 6.16% |

| Aviva | Age Partnership Lifestyle Flexible Option, Fixed ERC | N/A |

| Canada Life | Age Partnership Ultra Lite Plus Fixed ERC | 6.20% |

| Canada Life | Capital Select Ultra Lite Plus Fixed ERC | 6.24% |

| Just Retirement | Age Partnership J1 Lump Sum (>25% Payments) Fixed ERC (Enhanced) | 6.25% |

| Just Retirement | Age Partnership J1 Lump Sum (>25% Payments) Fixed ERC (Enhanced) | 6.25% |

| Canada Life | Age Partnership Super Lite Fixed ERC | 6.27% |

| Just Retirement | Age Partnership J2 Lump Sum (>25% Payments) Fixed ERC (Enhanced) | 6.28% |

Updated: 18/02/2025

How Did We Review the Best Equity Release Solicitors?

We reviewed the best equity release solicitors by following a detailed and thorough research process to compile a list of the top solicitors specialising in equity release.

We took a multifaceted approach, starting with an examination of online reviews, years of experience, and the range of services offered by each solicitor.

Throughout the process, we verified claims, consulted independent sources, and gathered feedback from clients to ensure an unbiased and comprehensive evaluation.

What Are the Benefits of Hiring Top-Notch Equity Release Solicitors?

The benefits of hiring top-notch equity release solicitors include receiving expert legal advice that ensures the transaction is fully understood, particularly regarding the long-term financial implications.

Additionally, they can help you navigate negotiations with lenders, ensuring you get the best possible deal and ultimately leading to a smoother, more secure equity release process.

Let's break down these benefits:

Ensuring a Smooth and Hassle-Free Process

Ensuring a smooth and hassle-free equity release process is the name of the game when it comes to experienced solicitors who can guide you through each step, from initial inquiry to finalising the agreement.

Your solicitor will assist you with:

- Guidance from Start to Finish: From understanding different schemes like lifetime mortgages or home reversion plans, to finalising the deal.

- Liaising with Stakeholders: This involves communication with providers, possibly current mortgage lenders, and even surveyors if property valuation is required.

Legal Protection and Safeguarding Your Interests

Legal protection and safeguarding your interests in equity release are the key factors to a secure and transparent process; experienced solicitors will ensure that the terms of the equity release plan are fully explained, particularly regarding potential financial impacts and future financial obligations.

Expect your solicitor to assist with:

- Reviewing Contractual Terms: Ensuring that the terms of the loan are transparent, fair, and in the homeowner's best interest.

- Legal Compliance: Making certain that all procedures align with UK equity release regulations.

Potential Pitfalls: What to Watch Out for When Choosing a Solicitor

When choosing a solicitor for equity release, always watch out for potential pitfalls that could affect the quality of service you receive; one common issue is selecting a solicitor without specialist expertise in equity release, which can lead to misunderstandings about the terms and long-term consequences of the plan.

Avoid solicitors who are not independent or who have close ties with lenders, as this may affect the impartiality of their advice, and be cautious of hidden fees or unclear costs that could inflate the total price of your equity release plan.

Here are some tips on how to stay alert:

- Lack of Transparency: Be wary of solicitors who are not transparent about their fees or the overall process.

- Limited Experience in Equity Release: Given the speciality of these products, a solicitor primarily focused on other areas of law might not be the best choice.

- Delayed Responses: A solicitor who does not promptly respond to your queries might indicate a lack of commitment.

- Hidden Fees: Ensure all costs are upfront. Any mention of "additional costs" that are not clarified should be approached with caution.

- Decreasing Inheritance: Releasing property value can reduce the overall worth of an estate, potentially diminishing the inheritance left for heirs.

- Impact on Benefits: Accessing equity may affect eligibility for means-tested state benefits, such as Pension Credit or Council Tax Reduction.

- Potential Increase in Interest Rates: Variable interest rates on plans can fluctuate, potentially increasing the total repayment amount over time.

- Do Your Research: Before finalising a solicitor, it is beneficial to research their background, reviews, and areas of expertise.

- Ask Questions: Do not hesitate to ask questions. A competent solicitor will be willing to clarify any doubts.

- Seek Recommendations: Personal recommendations or endorsements from trusted sources can often lead to finding a reputable solicitor.

Common Questions

Who Are the Best Equity Release Solicitors in the UK?

Which Equity Release Solicitors Have the Highest Ratings?

What Services Do the Best Equity Release Solicitors Provide?

What Are the Fees for the Best Equity Release Solicitors?

Can I Change My Solicitor Midway Through the Process of Releasing Equity?

Are There Online Platforms to Compare and Review Equity Release Solicitors?

What Is the Difference Between an Equity Release Adviser and a Solicitor?

How Often Will I Need to Meet with My Solicitor During the Process?

Are There Any DIY Alternatives to Hiring a Solicitor for Equity Release?

Can I Get a Refund If I Am Unsatisfied with My Solicitor's Services?

What Happens If There Is a Dispute or Misunderstanding with My Solicitor?

In Conclusion

Solicitors are invaluable when it comes to navigating home equity financial solutions in the UK.

With their legal expertise, their advice goes beyond the basics, guiding homeowners interested in equity release and offering personalised guidance to address the specific nuances of this financial product.

By partnering with the right equity release solicitor, you ensure a smooth, well-informed, and legally secure decision-making process.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.