- Seniors can seek expert equity release advice from authorised financial advisers; independent advice is essential to tailoring equity release plans to individual financial situations and long-term needs.

- Advisers, who should be members of the Equity Release Council and hold relevant qualifications, can help navigate common pitfalls, like underestimating future needs or opting for inflexible plans.

- Consultations typically involve a financial review, discussion of various plans, and addressing specific concerns.

Before deciding to unlock equity from their property, many homeowners wonder if seeking professional equity release advice is essential.

Diving into this process without expert insight might lead to unexpected hurdles and complications.

Is it essential?

In This Article, You Will Discover:

Our financial experts at BankingTimes keep a close eye on market developments and changes to ensure we provide you with the most precise and up-to-date information regarding later-life lending matters.

Let us explore why professional advice is indispensable and how it can steer your decisions in the right direction.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Is the Best Source for Reliable Equity Release Advice?

The best source for reliable equity release advice would undoubtedly be a certified financial adviser with extensive experience in retirement planning and equity release schemes.

These professionals have the requisite knowledge and skills to guide homeowners through the complexities of releasing equity from their homes.

They can offer unbiased advice as they're bound by a professional code of conduct that requires them to act in their clients' best interests.

Furthermore, you can also look for dependable advice from established financial institutions and reputable organizations specializing in equity release.

Make sure these institutions are regulated by the Financial Conduct Authority (FCA) for assurance of their credibility.

Websites like the Equity Release Council also offer valuable information and can point you towards accredited advisers in your area.

Remember, obtaining advice from trustworthy and accredited sources is crucial to make an informed decision about equity release.

Must I Get Equity Release Advice?

Releasing equity is a complex and potentially risky financial decision, so it is important to get professional advice before committing to a plan.

In fact, providers will only accept applications from customers who have received advice from a qualified adviser or broker.

Is it Mandatory to Get Professional Equity Release Advice?

Yes, in the UK, it is mandatory to receive professional financial advice before proceeding with this form of borrowing.

The primary reasons for this requirement are:

- Consumer Protection: It is a long-term financial commitment that can significantly affect your financial future, inheritance, and tax situation. Proper advice ensures that consumers fully understand the implications of their decisions.

- Complexity of Products: There are different types of products, each with its terms, conditions, and features. A professional adviser or broker can help you navigate through these options to find the most suitable product to fit your needs.

- Regulation and Standards: Regulatory bodies in many countries have set standards for these products to ensure that consumers are treated fairly. These bodies often require that professional advice be provided to maintain these standards.

- Avoiding Mistakes: Given the potential for long-term consequences, errors in selecting or executing this type of loan can be very costly. Professional advice helps in minimizing the chances of such mistakes.

- Exploring Alternatives: A qualified adviser or broker can help you explore alternative financial solutions that might be more appropriate for your circumstances.

Other Key Reasons to Get Advice

Beyond the fact that you are required to seek professional advice, here are 3 more primary reasons why it is invaluable:

- Gaining Insight into Available Options: Advisors provide a comprehensive overview of all available plans, allowing you to make an informed decision.

- Mitigating Risks: With their expertise, advisors or brokers can highlight potential risks and help you create strategies to help mitigate them.

- Achieving the Best Deal: With a keen eye on the market, advisors ensure you secure the most advantageous and cost-effective terms.

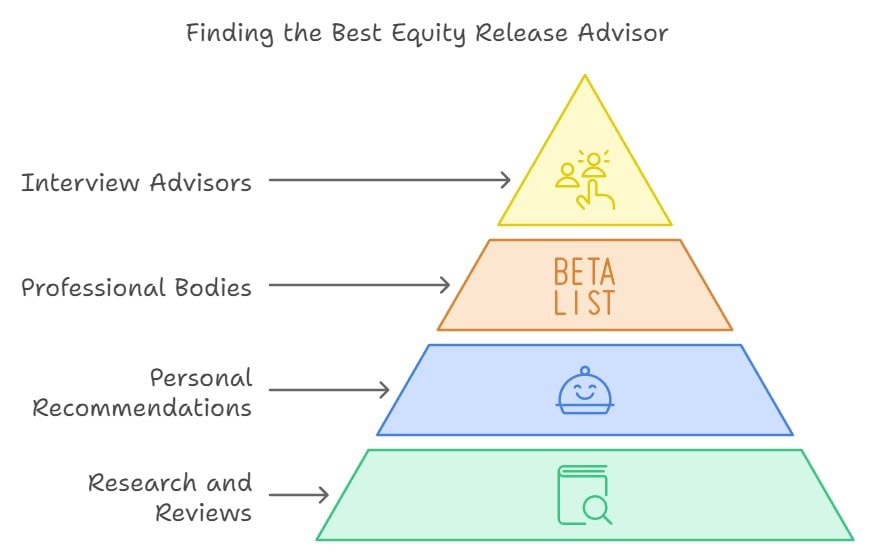

Where to Find the Best Equity Release Advisor for You

Here is a quick roadmap to help you locate the best advisor tailored to your needs:

- Research and Reviews: Start with a basic online search. Platforms like Trustpilot1 and Reviews.IO2 can offer insights into client experiences with various advisors.

- Personal Recommendations: Word of mouth is powerful. Ask for recommendations from friends or family members who have firsthand experience with these loans.

- Professional Bodies: Check the Equity Release Council's (ERC’s) website.3 It lists reputable advisors who adhere to its standards of conduct.

- Interview Potential Advisors: Once you have shortlisted a few, arrange face-to-face or virtual meetings. This gives you a feel for their expertise and whether you are comfortable with them.

Questions to Ask Your Advisor

Before you meet with your advisor, consider preparing the following vital questions:

- How does the equity release process work?

- Considering my situation, would I qualify?

- Can you summarise the primary benefits and risks?

- Are there any other financial strategies better suited to my circumstances?

- Which specific products would you suggest for my objectives?

- What are the fees and costs associated?

Preparing these questions in advance will demonstrate that you are proactive and thorough, ensuring that you address all essential aspects during your consultation.

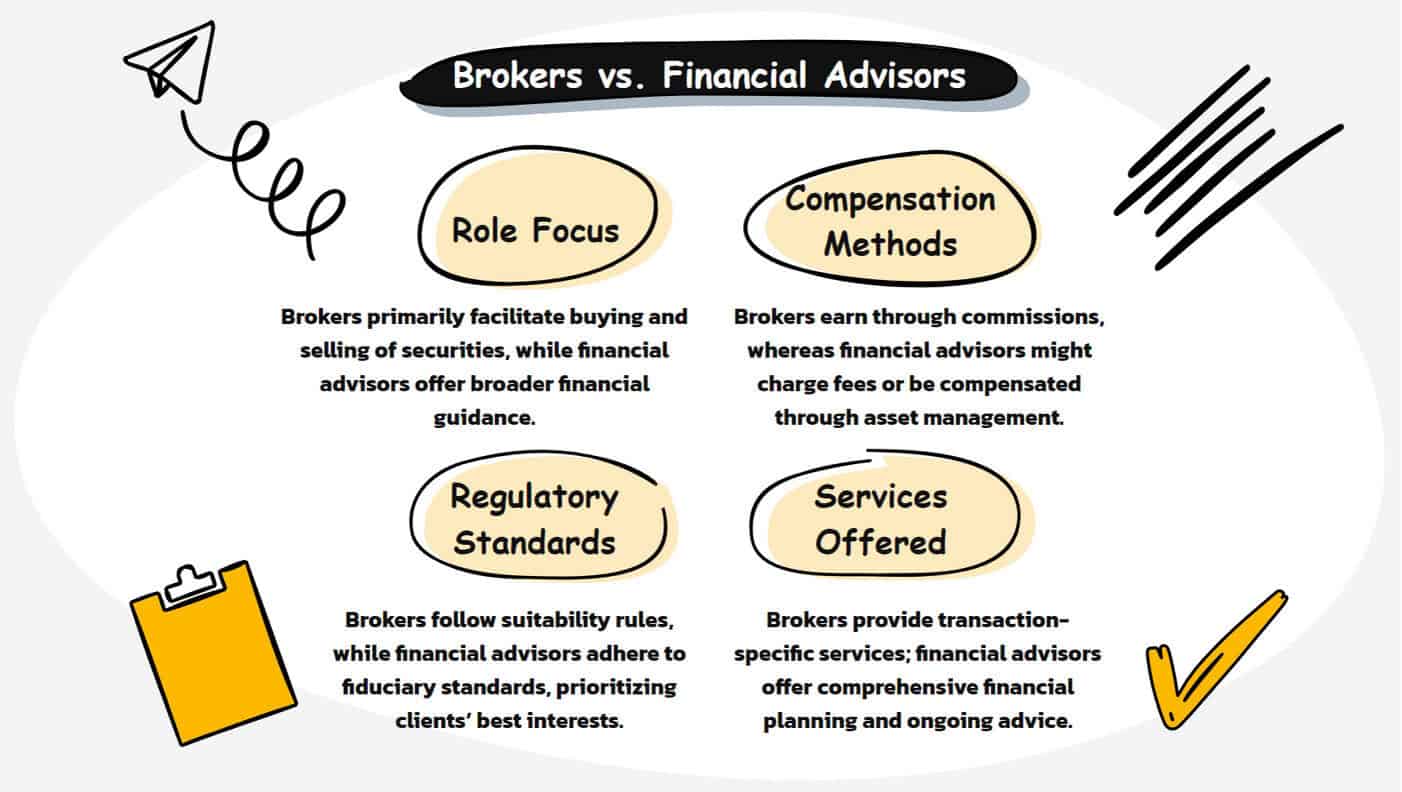

What Is the Difference Between Brokers and Financial Advisors?

Brokers and financial advisors, though both important and involved in the world of equity release, are not the same, but both offer advice.

Here is how they differ:

- Brokers: serve as intermediaries who connect you with providers, diligently searching for and comparing various plans to find the perfect fit. They often have access to exclusive deals and are compensated through commissions or direct client fees.

- Financial advisors: offer a more comprehensive financial outlook. They assess your overall financial situation and help you understand how releasing equity aligns with your broader financial goals. Operating under stringent regulations, they always prioritise your best interests.

How Much Do Equity Release Advisors Charge?

Professional advisor fees can differ based on their pricing model, expertise, and the range of services they provide.

Some professionals charge a fixed fee. This means you will know exactly what you owe from the outset, regardless of the size or complexity of the plan you choose.

Conversely, some earn their income through commissions. In these cases, they receive compensation from the provider upon your plan's completion.4

Some lenders have in-house advisers and the cost of advice will be included in your application fees.

Common Questions

What Is the Best Equity Release Advice for Homeowners Over 65?

Where Can I Find Free Equity Release Advice in the UK?

How Reliable is Online Equity Release Advice?

What Are the Risks and Benefits Explained in Equity Release Advice?

Is Equity Release Advice Necessary Before Making a Decision?

What Should I Consider When Selecting an Equity Release Advisor?

How Do Financial Regulations Affect Advice?

Can I Trust Online Advice Sources, or Is a Face-To-Face Advisor Better?

What Role Do Advisors Play in Safeguarding My Financial Interests?

How Does Advice Contribute to Responsible Borrowing and Informed Decision-Making?

Are There Any Scenarios Where Advice May Not Be Necessary?

Conclusion

Adhering to stringent financial regulations and navigating the complexities of equity release make professional advice indispensable for responsible borrowing and informed decision-making.

Ensuring the safeguarding of your financial interests, it instills confidence and prudence throughout this intricate journey.

So, to answer the vital question, "Must I get equity release advice?" – in the UK, obtaining professional guidance is a fundamental and necessary step for individuals considering this financial option.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.