- To spot disreputable equity release providers, check if they are registered with the Equity Release Council to ensure they meet safe practice standards by confirming their authorization with the Financial Conduct Authority (FCA).

- Avoid pitfalls by ensuring the provider is compliant with regulations and has good customer satisfaction ratings, steering clear of providers with consistently poor feedback.

- Be wary of equity release companies using aggressive sales tactics, lacking transparency in terms and conditions, and not offering fixed-rate options.

Before you tap into your home's value, it's crucial to know which equity release companies to avoid.

At BankingTimes we're committed to empowering you with trustworthy information to navigate the complex world of equity release.

In our comprehensive guide we expose red flags, reveal hidden dangers, and equip you with expert knowledge to make informed decisions for your financial future.

In This Article, You Will Discover:

Don't risk making a costly mistake; read on and protect your hard-earned wealth.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

How Does Equity Release Work and What Protections Are in Place for You?

Navigating the world of equity release can be complex, but understanding its mechanisms and the safeguards established to protect homeowners can offer peace of mind and security.

How Does Equity Release Work in the UK?

Equity release in the UK allows homeowners aged 55 and over to access the equity tied up in their homes without the need to move.

There are two main types: lifetime mortgages and home reversion plans.

A lifetime mortgage is a loan secured against your home, while a home reversion plan involves selling a part or all of your home to a company in exchange for a lump sum or drawdown cash reserve, yet allowing you to remain living there.

Read On: The Way Equity Release Works in the UK

How Does the Equity Release Council Protect Consumers?

The Equity Release Council is a regulatory body that ensures equity release products are safe and accessible for consumers.

It provides protection by ensuring all members adhere to strict standards and principles,1 such as the no negative equity guarantee, which ensures you never owe more than the value of your home.

Read On: Understanding More About the Equity Release Council

How to Identify Equity Release Companies to Avoid and Find the Best Providers

Selecting an equity release company is a critical decision that requires careful scrutiny of its policies, customer feedback, and adherence to regulatory standards to ensure a secure and beneficial agreement.

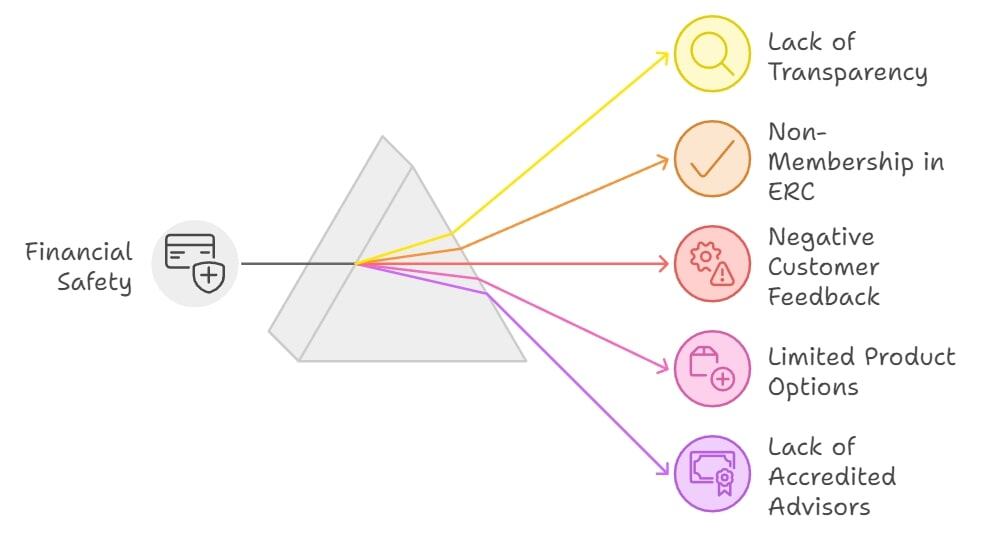

How Can You Identify Equity Release Companies to Avoid?

Identifying equity release companies to avoid is critical for safeguarding your financial future.

Here are some key indicators to help you steer clear of less reputable firms:

- Lack of Transparency: Avoid companies that are not upfront about fees, interest rates, and terms.

- Non-Membership in the Equity Release Council (ERC): Look for ERC membership as a sign of adherence to strict standards and consumer protections.

- Negative Customer Feedback: Be wary of companies with a pattern of complaints about poor communication, hidden fees, or pressure selling tactics.

- Limited Product Options: Avoid companies that push one product without considering your specific needs.

- Lack of Accredited Advisors: Ensure advisors have the necessary qualifications to demonstrate their expertise in equity release.

Focusing on these signs will assist you in avoiding less trustworthy equity release firms, guaranteeing you collaborate with a company that matches your financial objectives and delivers superior service and security.

How Can You Choose the Best Equity Release Companies?

Choosing the best equity release company involves careful consideration to ensure that you find a provider that offers not only competitive terms but also high-quality service and strong consumer protections.

Here are steps to guide you in selecting the most suitable equity release company:

- Research and Compare: Start with thorough research. Look into various equity release companies and compare their offerings. Focus on interest rates, fees, and the flexibility of their plans.

- Check for ERC Membership: Ensure the company is a member of the Equity Release Council (ERC). Membership signifies adherence to strict standards designed to protect consumers, including the No Negative Equity Guarantee.

- Read Customer Reviews: Customer feedback can provide insights into a company's service quality and customer satisfaction levels. Look for reviews on independent platforms for unbiased opinions.

- Seek Independent Advice: Consulting with an independent financial advisor who specializes in equity release can provide you with impartial advice tailored to your financial situation and goals.

- Evaluate Product Options: Look for companies that offer a range of equity release products. This diversity indicates that they can cater to different needs and preferences, allowing for a more personalised approach.

- Assess Customer Service: Good customer service is crucial. Consider companies known for their responsiveness, transparency, and willingness to provide clear, understandable information about their products.

- Understand the Fees: Be clear on all the fees involved, including setup fees, advice fees (if any), and any penalties for early repayment. Opt for companies that are transparent and upfront about costs.

- Consider Flexibility: Flexibility in terms of making repayments, downsizing, or moving to a new house is important. Companies that offer plans with these features provide more control over your financial future.

- Financial Stability: Opt for companies with a strong financial background and a good reputation in the market. This ensures that they are likely to be reliable partners over the long term.

By following these steps, you can narrow down your options and choose an equity release company that best fits your needs.

How to Vet Your Equity Release Advisor and Solicitor for the Best Results

The quality of advice you receive on equity release can significantly impact your decision-making process, highlighting the importance of choosing advisors and solicitors with expertise and a strong ethical commitment.

How Do You Spot Red Flags in Equity Release Advisors?

When seeking advice on equity release, it's crucial to be aware of red flags that may indicate an advisor is not the best fit for your needs.

Here are some key areas to consider:

- Lack of Accreditation: Advisors should have the necessary qualifications and regulatory approval, ensuring they're equipped to offer competent advice.

- Pressure Sales Tactics: A reputable advisor will allow you to make decisions at your own pace, without pressuring you into quick commitments.

- Inadequate Explanation of Risks and Benefits: Advisors must thoroughly explain both the advantages and potential downsides of equity release plans, ensuring you have a comprehensive understanding.

Always prioritise advisors who demonstrate transparency and are regulated by the Financial Conduct Authority (FCA),2 ensuring they meet high standards of professional conduct.

How to Choose Equity Release Solicitors and Avoid Common Pitfalls

Selecting the right equity release solicitor involves several key considerations to ensure you receive expert legal advice without encountering common pitfalls.

Some pitfalls to be aware of include:

- Experience in Equity Release: Choose a solicitor with specific experience in equity release to navigate the intricate legal aspects effectively.

- Membership in Professional Bodies: Solicitors who are members of recognised professional bodies adhere to strict ethical standards and are committed to ongoing professional development.

- Transparent Fee Structure: Ensure the solicitor offers a clear breakdown of their fees upfront to avoid unexpected costs later in the process.

By focusing on these criteria, you can avoid solicitors who lack the necessary expertise in equity release or who may not provide the level of transparency and professionalism you require.

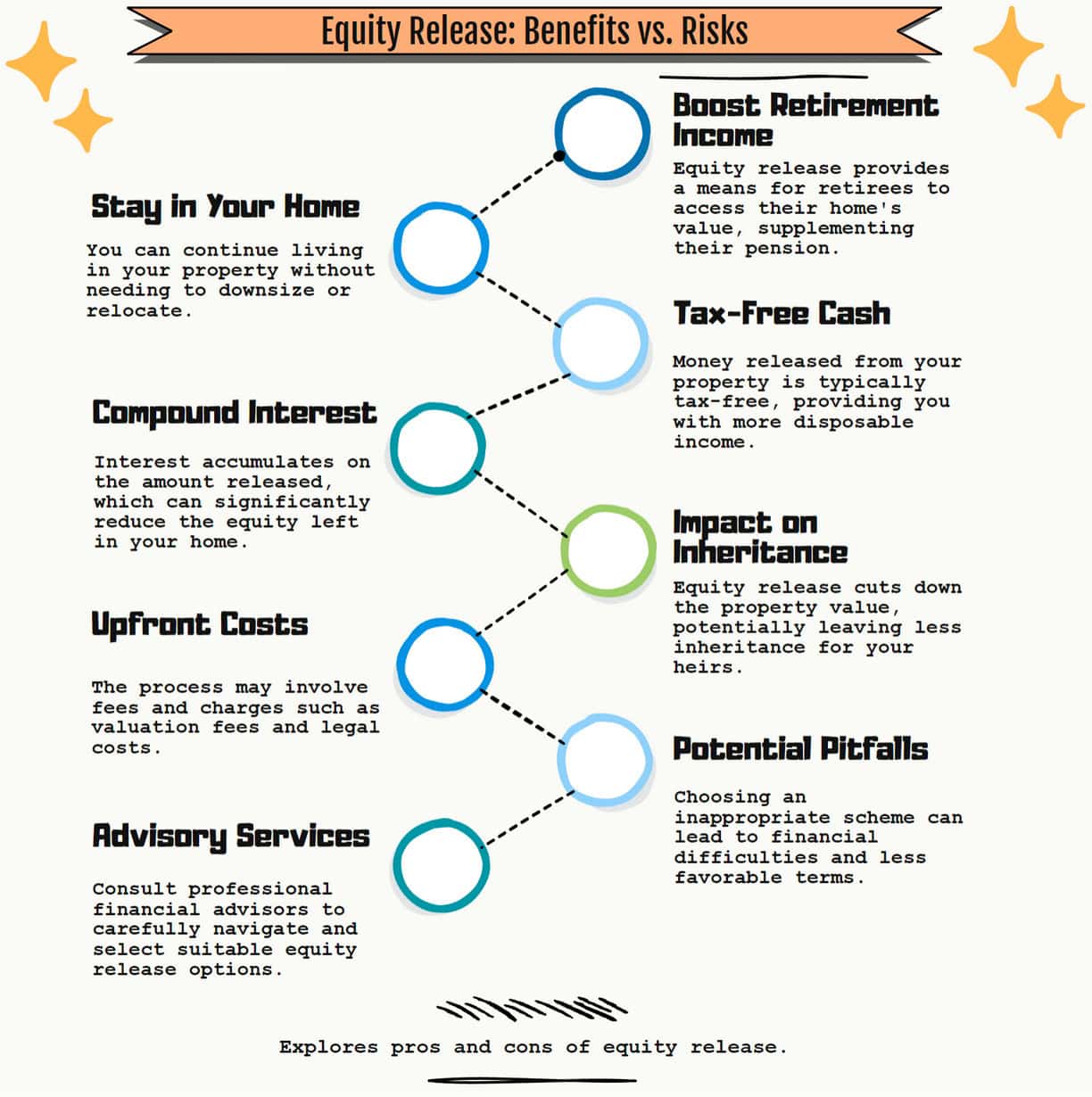

What Are the Risks and Benefits of Equity Release Schemes?

While equity release offers a lucrative avenue for accessing the wealth tied up in your home, weighing its advantages against potential risks is essential for informed financial planning.

What Are the Common Problems With Equity Release and How Can You Avoid Them?

Equity release schemes might pose challenges such as accruing high interest rates over time, diminishing the inheritance for your beneficiaries, and potentially affecting your eligibility for means-tested benefits.

To avoid these issues, engaging with an independent financial advisor is crucial. They can provide personalised advice to navigate equity release complexities.

Additionally

Selecting equity release plans that offer flexibility, including options for voluntary payments or adjustments based on changing financial situations, can help you maintain more control over your home's equity.

What Makes Downsizing Protection Essential in Equity Release Plans?

Downsizing protection3 in equity release plans is a critical feature that allows you to repay your loan without incurring early repayment charges if you decide to sell your home and move to a smaller property.

This protection is key for maintaining financial flexibility through various life stages, enabling you to adapt to changes such as the need for a different living space or the desire to be closer to family.

It also helps in preserving more of your home's equity for future use or as an inheritance, making it a valuable option for many homeowners.

Why Are Significant Life Event Exemptions Important in Equity Release?

Significant life event exemptions within equity release plans provide the flexibility to adjust or repay your plan early in specific circumstances, such as serious illness, without facing penalties.

These provisions offer peace of mind and security, ensuring that your financial arrangements can adapt to unexpected life changes.

The ability to modify your equity release plan in response to significant life events ensures that it remains aligned with your needs and circumstances, offering practical solutions during challenging times.

This adaptability enhances the overall appeal and utility of equity release for many homeowners.

Understanding the Financial Implications of Equity Release Options

Delving into the financial nuances of different equity release schemes is crucial for homeowners to ensure that the chosen plan aligns with their long-term financial goals and circumstances.

Why Avoid Variable Interest Rates in Equity Release?

Variable interest rates on equity release can fluctuate, leading to uncertainty in the total amount owed over time. This unpredictability can complicate financial planning and budgeting.

In contrast, plans with fixed interest rates provide a stable and predictable cost structure.

Knowing exactly how much will be owed enables clearer long-term financial planning and ensures there are no surprises in how interest accumulation affects the loan balance.

Should You Avoid Equity Release If Planning Early Repayment?

When contemplating equity release, it's important to consider your likelihood of wanting or needing to repay the loan early. This might be due to receiving an inheritance, selling the property, or simply wishing to reduce debt.

To accommodate potential early repayment without incurring excessive charges, it's advisable to select equity release plans that offer flexibility in repayment terms.

Some plans provide the option to make partial repayments without penalties, which can significantly reduce the long-term cost of the loan.

Discovering Insights and Evaluating Equity Release Companies in the UK

A thorough analysis and comparison of the top equity release companies in the UK can reveal valuable insights, helping potential borrowers to identify the most reputable and beneficial providers.

Who Are the Top 10 Equity Release Companies in the UK and How Do They Compare?

Choosing the best equity release company depends on your individual needs and circumstances, as well as the interest rates, fees, features, and customer service of each provider.

Some of the top equity release companies in the UK are:

- Aviva: One of the largest and oldest providers, offering low interest rates, flexible features, and large loans.

- Legal & General (L&G): A well-known and trusted brand, offering competitive rates, high loan-to-value ratios, and a range of plans.

- More 2 Life: A specialist in later-life lending, offering flexible and innovative products, such as drawdown plans, inheritance protection, and cashback options.

- LV=: A mutual society with a strong reputation, offering low early-repayment charges, fixed and variable rates, and enhanced plans for those with health conditions.

- Canada Life: A leading provider with over 40 years of experience, offering a wide range of plans, such as voluntary repayment, interest-only, and income plans.

- Just: A provider that focuses on customers with health and lifestyle factors, offering enhanced plans with lower rates and higher loan amounts.

- Pure Retirement: A provider that aims to offer simple and transparent products, such as lump sum, drawdown, and interest-serviced plans.

- OneFamily: A provider that offers lifetime mortgages with a family focus, such as plans that allow family members to make contributions or receive an inheritance.

- Age Partnership: A broker that compares products from a panel of lenders, offering impartial advice, exclusive deals, and a free equity release calculator.

- Saga Equity Release: A provider that caters to the over-50s market, offering plans with fixed rates, no negative equity guarantee, and a free consultation service.

These are some of the best equity release companies in the UK, but they may not all be suitable for you.

It is important to compare different providers and products and seek independent financial advice before making a decision.

Equity release is a long-term commitment that can affect your income, tax, benefits, and inheritance, so you should weigh the pros and cons carefully.

What Are the Little-Known Truths About Equity Release Everyone Should Know?

There are some little-known truths about equity release that everyone should know before considering it.

Here are some of them:

- You don’t have to be retired to take out equity release. You can use it to supplement your income, pay off debts, or fund your lifestyle while you are still working.

- You can use equity release to buy another property. You can either use the cash to purchase a second home, a holiday home, or a buy-to-let property, or you can transfer your existing equity release plan to a new property.

- Having a bad credit history won’t usually stop you from being approved. Unlike conventional mortgages, equity release lenders are more concerned with the value of your property and your age than your credit score.

- You could access a better equity release deal if you have a health condition. Some providers offer enhanced plans that take into account your health and lifestyle factors, such as smoking, diabetes, or high blood pressure. This could result in lower interest rates and higher loan amounts.

Equity release can be a useful option for some people, but it is not without risks and costs.

Therefore, it is important to seek independent financial advice and compare different providers and products before making a decision.

Read More: What Can Equity Release Funds be Used For?

The Importance of Consumer Feedback in Shaping Equity Release Services

Consumer feedback plays a pivotal role in enhancing the quality and transparency of equity release services, offering a powerful tool for future customers to navigate the market more effectively.

How Valuable Is Your Feedback on Equity Release Companies?

Consumer feedback is crucial for improving equity release services and products. It helps prospective customers make informed decisions and encourages companies to maintain high standards.

What Are the Key Risk Warnings of Equity Release You Need to Be Aware Of?

Being aware of the risks, such as the impact on inheritance and personal finances, is essential. Understanding these risks helps in making a decision that aligns with your long-term financial goals.

Common Questions

What Are the Red Flags When Choosing an Equity Release Company?

How Can I Verify if an Equity Release Company is Regulated?

What Are the Common Complaints Against Equity Release Companies?

How Do Interest Rates Compare Among Different Equity Release Providers?

Can I Switch Equity Release Companies After Signing a Contract?

What Are the Differences Between Equity Release Council Members and Non-Members?

How Can I Find Independent Reviews of Equity Release Companies?

What Should I Do if I Feel Pressured by an Equity Release Advisor?

Are There Any Equity Release Companies I Should Avoid Due to Poor Customer Service?

How Do Early Repayment Charges Vary Among Equity Release Companies?

What Questions Should I Ask an Equity Release Company Before Signing Up?

Conclusion

Choosing the right equity release company and plan requires diligent research, expert guidance, and a thorough understanding of the options available in this complex landscape.

By delving into the mechanisms, safeguards, and potential pitfalls, you empower yourself to make informed decisions that align with your financial goals and lifestyle aspirations.

Remember, maximising the benefits of equity release while minimising drawbacks requires a meticulous approach.

Dedicate the necessary time and effort to discern which equity release companies to avoid, and which can offer a secure plan that's tailored to your unique needs and aspirations.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.