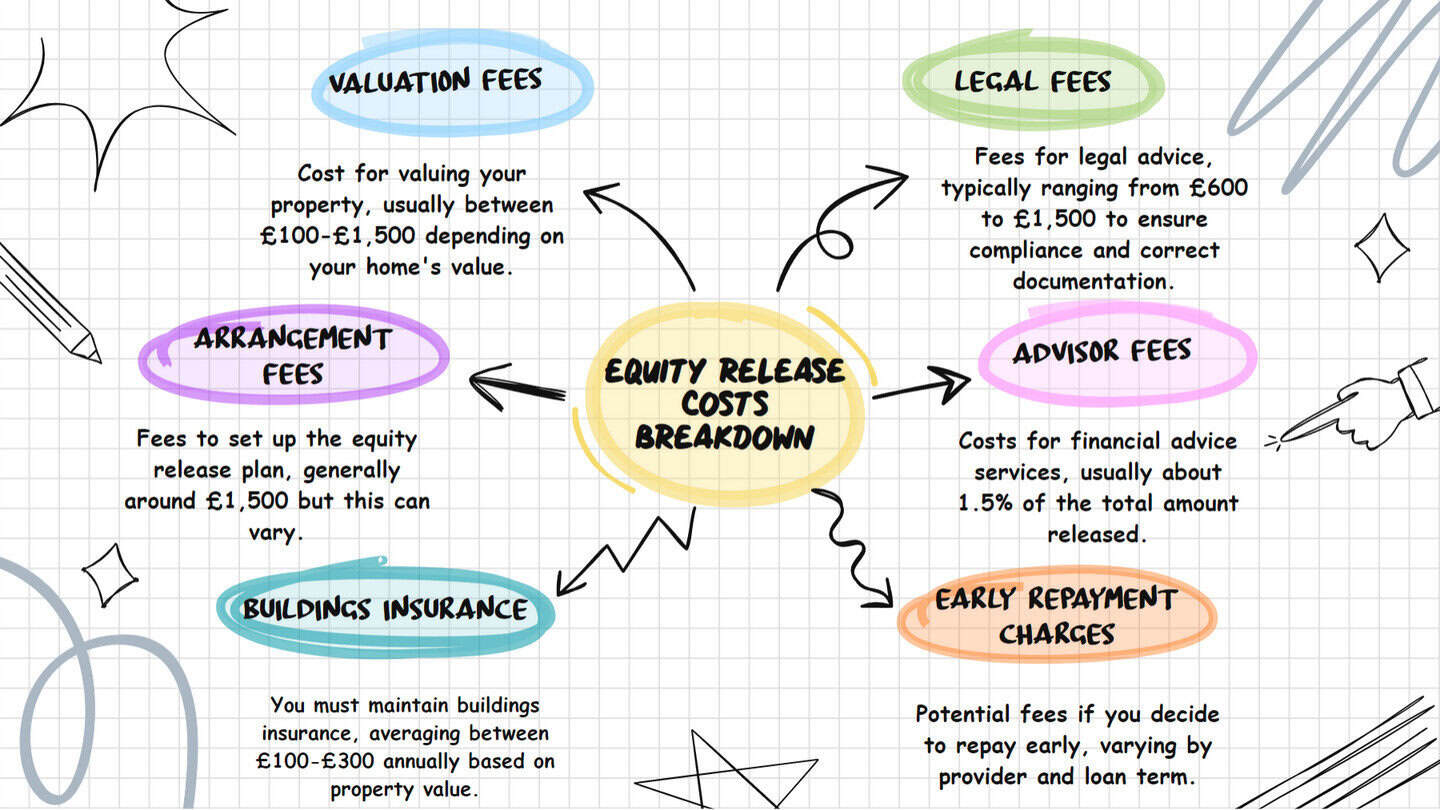

- Equity release involves costs such as setup fees, legal fees, and advice fees, generally ranging from 1-3% of the amount released and differing across providers due to varying interest rates, fee structures, and occasional special offers.

- Because the total fees depend on factors like the borrowed amount and administrative charges set by the provider, reduce said costs by comparing various providers, negotiating fees, and choosing a plan that best suits your financial needs.

- Be cautious of hidden charges, including early repayment charges, completion fees, and valuation fees.

As more homeowners explore the potential of their property's value, a clear picture of equity release costs becomes essential.

These costs, often overlooked, play a key role in ensuring that you maximise the benefits of releasing equity without unexpected financial burdens.

In This Article, You Will Discover:

From the foundational charges to hidden fees, this guide explains the range of costs associated with unlocking property value to help you make fully informed and prepared financial choices.

Let us get started.

What Are the Typical Costs Associated with Equity Release in the UK?

Equity release in the UK typically involves several costs including arrangement or application fees, valuation fees, solicitor's fees, and advisory fees.

Arrangement fees can be up to £2,000, valuation fees depend on the property's value (around £200-£600), while solicitor and advisory fees may vary.

Additionally, there might be an early repayment charge if the equity release plan is settled before its term.

There are also potential costs involved with equity release plans themselves.

The most significant is the accumulating interest, which can significantly increase the amount you owe over time.

Some equity release schemes may have additional charges such as set-up, completion, or administration fees.

The total cost can be substantial, hence it's crucial to understand all associated costs before proceeding with equity release in the UK.

Initial Costs

Understanding these costs, from application fees to property valuation charges, is the key to unlocking your property's full potential without unnecessary financial burdens.

Here is a breakdown.

Application and Administration Fees

These fees cater to the administration involved in setting up and processing your application and will differ from one lender to the next.

Market conditions, the provider's scale of operations, and your chosen release type can influence these charges.

Also

Some providers might refund part of the fee if the application does not proceed or will offer a free initial consultation. It is worth confirming this beforehand.

Professional Advice and Advisor Fees

The UK's robust regulatory framework necessitates professional consultation before finalising an equity release product. This ensures alignment with a homeowner's financial landscape.

Depending on the advisor's reputation, whether you use an independent advisor or opt for an in-house option, and the intricacy of your financial needs, fees can range from £750 upwards.1 Others may offer 1% to 2% of the amount you release.

It is prudent to verify if advisors are affiliated with recognised industry associations or have notable certifications.

Some advisors offer an initial, no-charge session, giving you a feel for their expertise before committing.

Property Valuation Costs

The amount of equity one can release is intrinsically tied to the property's value. Hence, a professional valuation is paramount.

This valuation accounts for various factors: the property's age, structural integrity, location, and any modifications or renovations undertaken.

Ultimately

The fees for this service vary, influenced by the property's value and the valuation firm or professionally engaged.

Legal Fees and Solicitor Charges

Legal expertise ensures the process of releasing equity complies with UK standards, protecting your interests.

Generally, charges hover around around £650 but can drastically differ.2 Factors like the property's location, unique clauses in the plan, and the solicitor's experience level can impact this.

Solicitors might offer fixed-fee services, ensuring transparency. Alternatively, hourly rates could be beneficial for simpler cases.

Some even provide packages inclusive of valuation and advice fees, offering a one-stop solution.

Ongoing Costs and Hidden Charges

While the upfront costs are more apparent, the subsequent ongoing and potentially hidden charges are equally critical to understand.

These include interest accumulation, early repayment charges, property maintenance requirements, and insurance premiums.

A good financial or broker will talk you through these so you do not enter a plan blindly.

Interest Accumulation

When you release equity, you are often charged interest on both the principal amount and any previously accumulated interest.

This phenomenon, known as compounding, can cause the owed amount to increase significantly over time.

For a £50,000 equity release with a 5% interest rate, the yearly interest is not just £2,500. Because of compounding, the interest is calculated on an ever-growing sum, leading to a rising debt.

*These figures are an example for indicative purposes only.

Early Repayment Charges

If you decide to repay your loan earlier than agreed, you might face certain penalties.

These charges often come as a percentage that is on a sliding scale, based on how long you have had your plan.

It is crucial to be aware of these potential costs if you are contemplating early repayment.

Learn More: Understanding Early Repayment Charges

Property Maintenance Requirements

Certain equity release agreements stipulate that the property be maintained to a specified standard to protect the lender's interest, and failing to meet these standards can lead to additional costs for repairs or maintenance down the line.

Though sometimes costly, regular checks and timely renovations can help prevent substantial unexpected future expenses.

Insurance Premiums

While not always considered a 'hidden' charge, keeping your property insured3 might be a condition of the equity release plan.

If you do not already have insurance, this becomes an additional ongoing cost to consider with premiums based on your property's location, size, and perceived risk factors.

What Are the Factors Determining Your Costs

Several factors influence the costs: From the type of plan chosen to prevailing market rates, it is vital to understand these variables to anticipate the expenses accurately.

Here is a breakdown.

Type of Plan

The type of plan you choose can largely dictate the associated costs.

For instance, a home reversion plan involves selling a portion of your home, and its costs are often linked to the home's valuation and the percentage being sold.

On the other hand, a lifetime mortgage has interest rates attached, and its costs might include early repayment charges, set-up fees, or ongoing administrative costs.

Property Value

Your property's current market value determines how much equity you can unlock.

For a property valued at £300,000, releasing 20% equity means obtaining £60,000.

However, if your property's value rises to £400,000, that same 20% would equate to £80,000.

While a higher property valuation can allow for a larger equity release, it might also come with elevated valuation fees or higher advisor commissions, given the larger sums involved.

*These figures are examples for indicative purposes only.

Your Age

Lenders factor in your age and sometimes health when determining the amount you can release and its cost.

Typically, as you age, you can access a more significant portion of your home's equity since the anticipated loan duration might be shorter.

For instance, a 70-year-old could potentially receive a more generous offer compared to someone aged 60, based on life expectancy statistics.

*These are only examples. A professional financial advisor or broker will assist with accessing an accurate quote.

Market Interest Rates and Provider Terms

The state of the broader financial market and prevailing interest rates will impact the cost of an equity release.

Each provider will have unique terms and fee structures, but generally, If market rates are high, the interest charged on a lifetime mortgage might also be higher.

For example, one provider might offer a fixed interest rate of 5% with no set-up fees, while another might offer a rate of 4.5% but charge an arrangement fee.

It is crucial to dissect and compare these elements across different providers to ensure you get the best deal.

*These figures are examples for indicative purposes only.

5 Tips and Strategies for Keeping Costs Down

Understanding the costs of unlocking equity is essential, but finding ways to mitigate these costs can be equally crucial.

Here are 5 strategies to ensure you get the most out of your property without unnecessary financial strain:

#1. Shop Around

Just as you would when looking for a mortgage or insurance policy, it is crucial to compare various providers, as each lender may offer different rates, fees, and terms.

By broadening your search and comparing options, you can find a provider that offers the best value for your property and circumstances.

#2. Negotiation

Believe it or not, many fees in the process could potentially be negotiable.

Do not hesitate to discuss the possibility of lowering these costs, whether it is the application fee, valuation fee, or advisor charges.

Providers might be willing to give a discount or waive certain charges, especially if they are keen on having you as a client.

#3. Taking Regular Professional Advice

The world of equity release is ever-evolving with changes in regulations, market rates, and other influencing factors.

Regularly consulting with a professional can keep you updated on these shifts, potentially unveiling new opportunities for cost savings or highlighting more beneficial terms available in the market.

#4. Opting for Favourable Plans

Some plans inherently come with better terms and flexibility.

For instance, the drawdown lifetime mortgage allows you to release money in stages rather than a lump sum, often leading to lower interest costs over time.

Selecting a plan tailored to your needs and circumstances can result in significant cost savings.

#5. Property Upkeep

One of the conditions of many agreements is that the property is kept in good condition.

A well-maintained home can fetch a better valuation, potentially leading to more favourable terms when releasing equity.

Regular inspections and addressing small issues before they become significant problems can be a strategic move in the equity release journey.

Common Questions

What Are the Average Costs of Equity Release in the UK?

How Much Do Equity Release Plans Typically Cost?

What Are the Hidden Costs of Equity Release?

Can I Reduce the Costs of Equity Release?

Are There Any Ongoing Costs with Equity Release?

How Long Does the Equity Release Process Typically Take?

Are There Monthly Repayments in Equity Release Plans?

Will Equity Release Impact My Heirs’ Inheritance?

What Is the Loan-To-Value (LTV) Ratio, and Why Does It Matter?

Are There Cheaper Alternatives to Equity Release?

How Do I Ensure a Provider Is Transparent About Costs?

In Conclusion

Understanding the costs associated with unlocking property value in later life is crucial for homeowners in the UK contemplating this option.

While equity release can provide financial relief and the opportunity to tap into the value of your property without moving, it is important to consider the interest rates, set-up fees, and potential impact on your estate and entitlement to means-tested benefits.

It is essential to weigh these costs against the benefits and consult with a financial advisor to ensure that equity release is a suitable and sustainable solution for your financial needs.

Remember, the key to a sound financial decision is being fully informed on the equity release costs and considering both the immediate benefits and long-term implications of such.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.