- Equity release offers a cash boost for retirees wanting to stay put in their homes, and while a regulated and safe bet, one should double-check their situation and get outside professional advice.

- Ultimately, it's a great option for those requiring extra retirement funds or aiming for home improvements, but remember to weigh up the impact on estate and inheritance.

- The pros include cash flow without moving house, while the cons include less being left behind for the family and possibly being pricier than other financial retirement routes.

Is equity release a good idea? This is a frequently asked question many homeowners who are considering releasing equity from their homes are asking.

For many, it represents financial freedom, but the idea of leveraging one's home value without parting with it is both enticing and daunting.

Hence, knowing all the facts is important to determine if you’re making the right choice.

This guide aims to answer that question by shedding light on the world of mortgages in retirement to help homeowners make the best decisions for their financial vision.

Here’s what we’ve discovered.

In This Article, You Will Discover:

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Is Equity Release a Good Idea?

Equity release can be a good idea for homeowners seeking to unlock their home's value, and its suitability largely depends on individual circumstances.

To ascertain if it's for you, consider the following:

- Purpose - Assess if you need funds for essentials or leisure. Releasing property value can be vital for pressing financial needs.

- Inheritance Impact - It will reduce your estate's value, impacting the inheritance left for heirs.

- Current Debts - If you have an existing mortgage, the money released will first be used to clear that, affecting the amount you receive.

- Other Options - Consider alternatives, such as downsizing or other loan types.

- Benefits Impact - The additional income will alter eligibility for certain state benefits.

- Future Moves - It can limit your ability to relocate later.

- Seek Advice - Due to its complexities, consult a financial expert before deciding.

Equity Release Pros & Cons

To determine whether its a good option for you, you must first consider the different pros and cons of equity release.

Equity release provides financial flexibility and allows homeowners to remain in their cherished homes without monthly repayments, but it also comes with drawbacks like accruing interest, potential reduction in inheritance, and limitations on future housing choices.

The Pros Are:

- Financial Flexibility - Convert your home value into liquid capital for varied needs.

- Legacy of Comfort - Live in your home and relish the memories.

- No Monthly Repayments - Some schemes relieve the burden of monthly payouts.

- Negative Equity Protection - Guarantees the debt won’t exceed your home's value.

- Oversight by the ERC and the FCA - The industry is overseen and governed by the Equity Release Council (ERC)1 and the Financial Conduct Authority (FCA).2

The Cons Are:

- Cost of Borrowing - The released equity accrues interest, increasing the repayable amount.

- Legacy Implications - Reduced inheritance for your heirs.

- State Benefits Impact - This may affect eligibility for means-tested benefits.3

- Early Repayment Fees - Potential charges for settling the debt early.

- Inflexibility - Some plans may limit future housing choices.

Read More: Pros and Cons of Equity Release in the UK

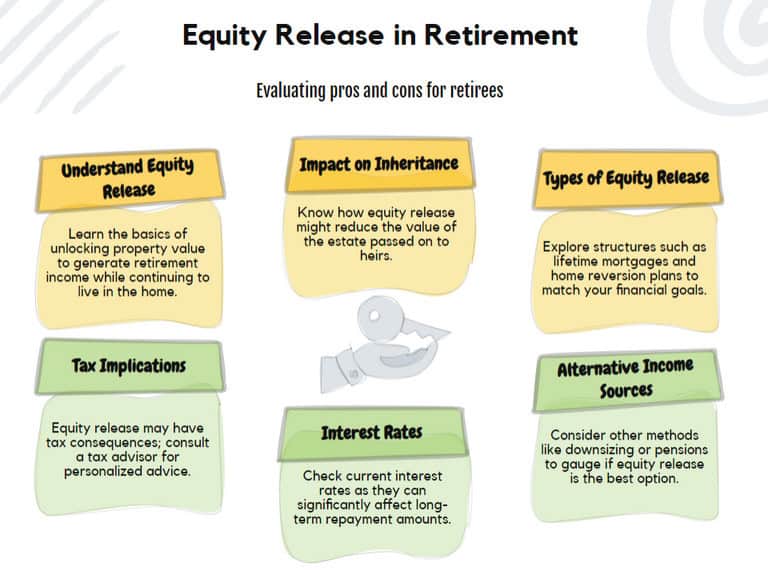

Is Equity Release a Good Idea for Retirement?

Equity release can be an effective tool for retirement, providing a cash boost to your income or a lump sum to fund large expenses.

It allows homeowners to tap into the value of their property without having to sell or move, with the loan being repaid from the property's eventual sale.

However, it isn't beneficial for everyone and it's essential to understand the long-term impact on your estate.

Equity release decreases the value of your estate and might affect your eligibility for means-tested benefits.

It can also come with significant costs and interest rates. The best decision will depend on individual circumstances, like financial needs, future plans, property value, and life expectancy.

We advise getting independent financial advice before making any decisions.

Equity Release Horror Stories

You may have heard several equity release horror stories like out-of-control debt, diminished inheritance, and harsh repayment charges.

Let's take a closer look:

- Skyrocketing Debt - In some cases, individuals have failed to grasp the implications of compound interest. Over time, the debt can grow significantly, in certain scenarios even doubling the initial borrowed amount.

- Diminished Inheritance - Some homeowners hoping to leave a substantial inheritance discover too late that the accumulating interest on their loan erodes much of the property's value, leaving little to nothing for heirs.

- Restrictive Terms - There have been instances where homeowners wanting to downsize faced prohibitive early repayment charges from their plan, making moving homes financially challenging.

- Unexpected Costs - Some people have been surprised by unforeseen fees and costs linked to their scheme, effectively reducing the funds they initially hoped to access.

- Loss of State Benefits - After accessing equity, certain individuals found that their increased "savings" affected their eligibility for previously available state benefits.

Equity Release Pitfalls

When releasing equity from your home, you must be aware of potential pitfalls, like escalating debts due to accumulating interest, seeing a reduced inheritance for your beneficiaries, or encountering hefty early repayment charges.

Some of the major potential pitfalls are:

- Accumulating Interest - Since the amount borrowed through equity release accumulates interest over time, homeowners can end up owing more than anticipated, especially if they live for many more years after the release.

- Reduced Inheritance - As the debt accrues, the amount available as inheritance for beneficiaries might reduce, sometimes significantly.

- Early Repayment Charges - Some plans have hefty penalties if homeowners decide to repay early. This can make switching to a better deal or paying off the loan costly.

- Limited Future Options - Once you've taken out an equity release, it may restrict your ability to downsize or move to a different property type in the future.

- Welfare Implications - Releasing equity can impact your entitlement to state benefits as your financial situation changes.

- Long-term Commitment - Equity release is a long-term decision, and getting out of an agreement can be complex and expensive.

Learn More: Switching Equity Release Plans

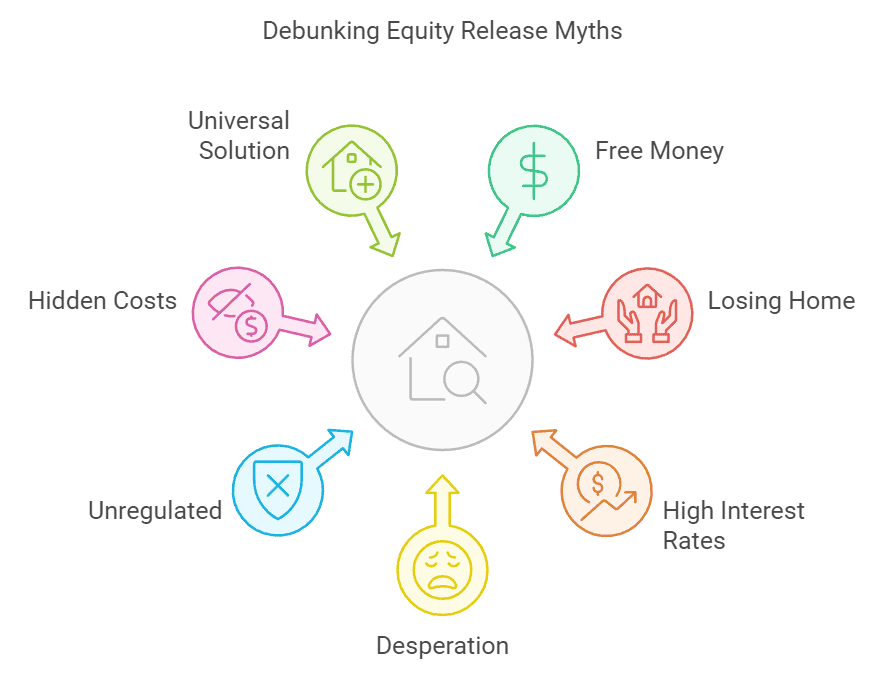

Equity Release Myths

Some of the biggest myths about release equity are that the money you receive is simply free cash, you can lose your house, or the risks far outweigh the benefits.

Let's debunk some of these prevalent misconceptions:

- It's Free Money - Some believe equity release is akin to winning the lottery: a lump sum with no strings attached. However, it’s a loan against your home’s value and needs to be repaid, usually with interest.

- You Can Lose Your Home - While you must adhere to the contract terms, modern schemes ensure you can live in your home until you pass away or move into long-term care.

- Interest Rates are Exorbitant - While rates can sometimes be higher than traditional mortgages, shopping around and seeking advice can lead to competitive rates.

- Only the Desperate Opt for Equity Release - Releasing your property value can be a strategic financial move, not merely a last resort. Many use it for home improvements, travel, or helping family members.

- Equity Release is Unregulated - Contrary to this myth, products and providers are regulated. For example, in the UK, they're regulated by the Financial Conduct Authority (FCA).

- There are Hidden Costs - Reputable providers and schemes should be transparent about all fees. This underscores the importance of understanding your contract and seeking independent financial advice.

- It’s a Universal Solution - Not every homeowner will qualify or should choose this option. Factors like age, property value, and location play a role in determining eligibility.

5 Reasons Why Equity Release Can Help You

Equity release can significantly benefit homeowners by addressing debt consolidation, home upgrades, and healthcare expenses, especially for older individuals seeking to improve their quality of life.

Here are the top 5 reasons how it can be beneficial:

- Debt Consolidation - Transform the equity in your home into liquid assets to clear multiple outstanding debts, simplifying your financial obligations.

- Home Improvements - Use the released funds to renovate or upgrade your property, potentially increasing its market value and enhancing living conditions.

- Healthcare Costs - Cover unexpected medical expenses or finance long-term care without draining your savings or other assets.

- Fulfilling Life Dreams - Whether traveling, pursuing a hobby, or starting a business, the funds can help realise dreams that might've been financially out of reach.

- Supporting Loved Ones - Assist family members with significant life events, like buying their first home, funding higher education, or helping with wedding expenses.

Common Questions

Is Equity Release a Good Idea for Retirement Planning?

What Are the Pros and Cons of Equity Release?

How Safe Is Equity Release as a Financial Strategy?

Should I Consider Equity Release for My Property?

When Is Equity Release Considered a Good Idea?

Is Equity Release Safe?

How Does Equity Release Affect My Taxes?

Can I Move to a New House After Releasing Equity?

What Happens if I Die Shortly After Releasing Equity?

Are There Age Restrictions for Equity Release?

Does the Type of Property I Own Impact My Eligibility?

Conclusion

Equity release can serve as a valuable financial tool, especially for those looking to optimise their assets in retirement.

However, as we’ve outlined, it comes with both benefits and potential drawbacks.

To answer, ‘is equity release a good idea?’ arming yourself with knowledge and seeking expert advice is paramount.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.