- Equity release schemes originated in the UK during the 1960s; significant milestones include the introduction of the no negative equity guarantee in the 1990s and the formation of the Equity Release Council in 1991, which set crucial industry standards for consumer protection.

- Legislative changes over the years, particularly those enhancing consumer protections and regulatory oversight, have contributed to making equity release safer and more attractive to consumers.

- The popularity of equity release has been influenced by historical interest rates, with lower rates making these schemes more appealing due to the reduced accrual of debt over time.

‘What Is the history of equity release?’ - exploring this question takes us through the decades to understand how this financial tool has evolved to meet the changing needs of homeowners.

But where did it all begin, and how has it evolved to become the regulated, consumer-focused industry it is today?

In This Article, You Will Discover:

From the seeds sown by innovative financial products in the pre-1980s to the structured, secure schemes now on offer, equity release products have a rich history interwoven with the fabric of the UK's economic and legislative developments.

Join us as we explore the journey of equity release - understanding its origins, triumphs, and the safeguards put in place to protect consumers like never before.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Is the History of Equity Release in the UK?

Equity release in the UK finds its roots back in the late 1960s with the establishment of equity release-like products by insurance companies.

These early products paved the way for the inception of formalized equity release schemes that began in the late 1980s, becoming more regulated and popular over the subsequent decades.

The 1990s witnessed the formation of Safe Home Income Plans (SHIP), now known as the Equity Release Council, which set out to protect consumers with a set of principles and regulations.

Since then, equity release products have evolved and diversified, providing seniors with various ways to tap into their home equity, making this financial tool an integral part of retirement planning in the UK.

The Inception of Equity Release (Pre-1980s)

Equity release's origins can be traced back to a time when financial regulation was in its nascent stages. Initially, these schemes were informal, tailored agreements without the consumer protections that define the modern equity release products.

The UK's post-war housing market boom and the subsequent rise in homeownership laid the groundwork for the idea of releasing equity.

It emerged as a solution for retirees to enhance their income, despite the higher consumer risks and the occasional unfavourable deal due to the lack of regulation.

Formalisation and Regulation (1986 - 1991)

The market reached a turning point with the Financial Services Act of 1986,1 which introduced a comprehensive regulatory framework.

This act marked the beginning of equity release's transformation into a recognised financial solution for homeowners.

Still, the industry was still dubias and could cause homeowners to lose their properties.

The establishment of SHIP in 19912 was a significant step towards consumer protection, promoting transparency and fairness in equity release schemes and setting a precedent for future industry standards.

The FSA Era and Market Growth (1997 - 2013)

The late 1990s and early 2000s signified a period of growth and maturation for the equity release sector, largely due to the oversight of the Financial Services Authority (FSA).3

The FSA's regulatory framework fostered consumer confidence and allowed for market innovation and expansion.

The market flourished with the advent of lifetime mortgages and the establishment of the Equity Release Council in 2012,4 which introduced standardised principles focused on customer welfare.

Strengthening Consumer Protection (2014 - 2019)

Following its transition from the Financial Services Authority (FSA) to the Financial Conduct Authority (FCA) in 2013, the regulator imposed more rigorous standards starting in 2014.5

The focus was intensified on responsible lending practices and meticulous risk evaluation to safeguard consumers and confirm the appropriateness of equity release offerings.

During this period, the market witnessed the introduction of innovative product features like the option for drawdowns and the implementation of the No Negative Equity Guarantee.

These advancements reinforced the protective measures for consumers and augmented the confidence and security of individuals taking out equity release plans.

Read On: Is Equity Release Actually Safe?

Equity Release Post-COVID World: A Modern Financial Solution (2020 - 2025)

The pandemic's economic impact led to increased interest in equity release as a means of financial support.

However, it also brought a heightened sense of caution among consumers regarding long-term financial commitments.

The low-interest-rate environment of the early 2020s made unlocking property value more appealing, with providers offering more flexible and customer-focused products to meet the evolving needs of post-COVID consumers.

Equity Release's Trajectory (2025 and Beyond)

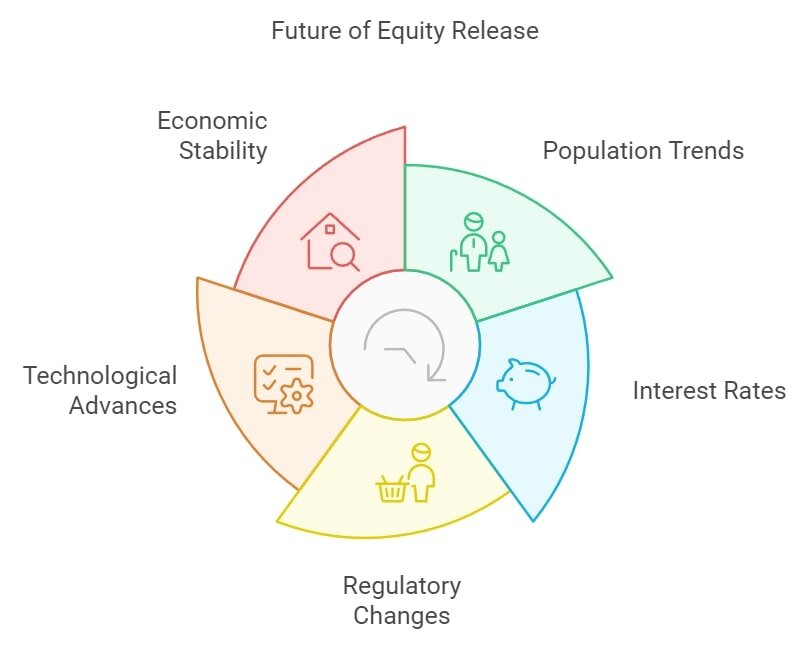

Looking into the future, the path of equity release will continue to be shaped by demographic shifts, regulatory reforms, and innovations in financial services.

Here is how these developments might chart the course for equity release from 2025 and beyond:

- Population Trends: An increase in the retiree population is expected to boost the use of equity release as more people look to their property wealth for retirement funds.

- Interest Rates: If the Bank of England stabilises interest rates, as predicted, we may see more attractive equity release options with potentially lower costs.

- Regulatory Changes: Stricter rules from the Equity Release Council will aim to protect consumers, ensuring they understand the risks and benefits.

- Technological Advances: Expect simpler and faster processes thanks to digital platforms, making it easier for homeowners to access their equity.

- Economic Stability: Despite economic shifts, property remains a steady investment. This stability supports the continued use of homes as a financial resource in retirement.

Common Questions

What Is the History of Equity Release in the UK?

How Has Equity Release Evolved Over Time?

What Significant Changes Have Occurred in the Equity Release Market?

Who Were the Pioneers in the UK Equity Release Market?

What Impact Has Legislation Had on the History of Equity Release?

What Are the Risks Involved in Equity Release?

Can Equity Release Affect My State Benefits?

How Does Equity Release Impact Inheritance?

What Happens if I Want to Move After Taking Out Equity Release?

Are There Alternatives to Equity Release?

How Do Interest Rates Affect Equity Release?

Conclusion

Equity release is a significant financial decision with long-term implications for your estate and retirement planning. It is crucial to understand the risks, impact on state benefits, inheritance, and alternatives.

Interest rates and guarantees like the No Negative Equity Guarantee play a pivotal role in the cost of these products.

Always ensure you deal with reputable companies and stay informed about legislative changes that may affect your decision.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.