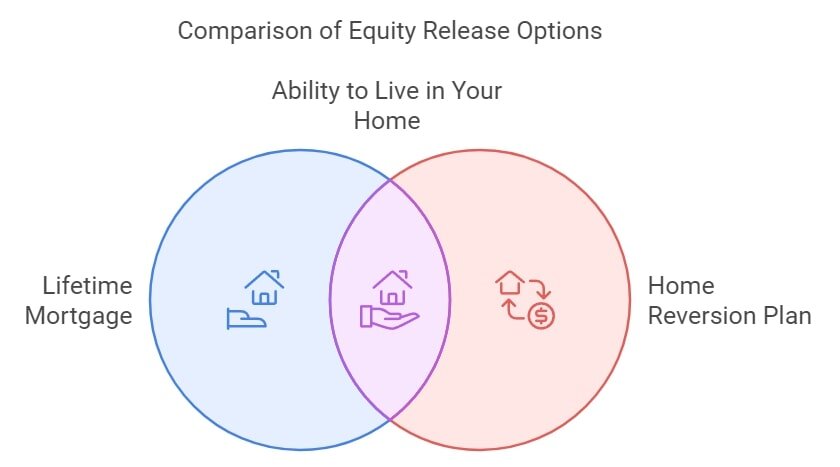

- Equity release primarily consists of lifetime mortgages and home reversion plans, each suited to different financial requirements, with innovations in plans offering enhanced flexibility and features to accommodate homeowner needs.

- In a home reversion plan, you sell a part of your home for a lump sum or regular payments, while a lifetime mortgage involves borrowing against your home's value and maintaining ownership.

- Choosing the right type of equity release requires evaluating your financial situation, future goals, and the terms offered by each plan.

Could your home hold the key to a more comfortable retirement? If you’re exploring ways to access its value, understanding the equity release types available is essential.

In the UK, there are 2 main options: lifetime mortgages and home reversion plans—but which one suits your needs best?

In this expert guide, we break down both options, explaining how they work, their pros and cons, and what to watch out for, and whether you're looking to boost your retirement income or support your family, we've got you covered.

Let’s dive in and find the perfect equity release solution for you...

In This Article, You Will Discover:

What Are the Different Types of Equity Release Available in the UK?

The different types of equity release available in the UK include lifetime mortgages and home reversion plans; a lifetime mortgage allows homeowners to borrow against their property while retaining ownership, while home reversion plans involve selling a portion or all of a property in exchange for a lump sum or regular payments.

Both options are regulated by the Financial Conduct Authority (FCA) and Equity Release Council (ERC), enabling you to live in your house for the remainder of your life or when it becomes necessary to move into a long-term care facility.

Let's look at these options:

Lifetime Mortgages

Lifetime mortgages, the most popular type of equity release, are very similar to a regular mortgage since the amount you borrow is secured against the value of your property.

The biggest difference is that you are not required to make regular repayments and that the outstanding debt is only due when you pass away or move into long-term care.

However, you could make voluntary repayments, although the terms and conditions would depend on the specific plan and provider.

Read On: Exploring the World of Lifetime Mortgages

Home Reversion Plans

Home reversion plans allow you to sell part or all of your property to a specialist provider while retaining the right to live in it rent-free for life—in exchange, you receive a tax-free lump sum or regular payments.

However, home reversion providers typically pay below market value for the share they purchase, and when your home is eventually sold—either after your passing or if you move into long-term care—the provider takes its agreed share of the proceeds.

Always note that because you receive less than full market value, a home reversion plan can significantly reduce the value of your estate, particularly if you pass away soon after taking out the scheme.

Read On: A Closer Look at Home Reversion Plans

What Are the Types of Lifetime Mortgages?

The types of lifetime mortgages include lump-sum lifetime mortgages, drawdown lifetime mortgages, enhanced lifetime mortgages, interest-only lifetime mortgages, and voluntary repayment plans.

Here's a closer look at each of these lifetime mortgage types:

Lump-Sum Lifetime Mortgages

A lump-sum lifetime mortgage allows you to release a large, tax-free amount secured against your home, and according to the ERC, this type of plan accounts for 54%1 of all new equity release agreements in recent years.

The loan is typically set at a fixed interest rate for life, and while some plans allow optional repayments, no monthly payments are required; however, interest accrues over time through compound interest, meaning the total amount owed can grow significantly.

If you're considering this option, it’s essential to understand how interest accumulation affects the overall debt and the eventual impact on your estate.

Read On: Unlocking the Benefits of Lump Sum Lifetime Mortgages

Drawdown Lifetime Mortgages

A drawdown lifetime mortgage lets you access your equity in smaller stages rather than taking the full amount upfront, with interest only charged on the funds you withdraw.

This flexible approach can reduce overall borrowing costs and help to slow down the accumulation of compound interest; however, each withdrawal is subject to the interest rate at the time, which may differ from your initial rate.

By releasing funds as needed, a drawdown plan can help manage costs while preserving more of your estate for the future.

Read On: How Drawdown Lifetime Mortgages Offer Financial Flexibility

Enhanced Lifetime Mortgages

An enhanced lifetime mortgage is a specialised equity release plan designed for homeowners with certain medical conditions or lifestyle factors that may shorten life expectancy.

Because of this, lenders may offer higher loan amounts or better interest rates compared to standard lifetime mortgages.

By factoring in health conditions, these plans allow eligible borrowers to access more tax-free cash from their property while potentially reducing the overall cost of borrowing.

Read On: Exploring Enhanced Lifetime Mortgages for Maximum Borrowing

Interest-Only Lifetime Mortgages

An interest-only lifetime mortgage allows you to borrow against your home's value while making monthly interest payments, preventing the loan from growing over time and proving a great option for those with a steady income who want to manage borrowing costs while still accessing the benefits of equity release.

By keeping up with these payments, you maintain the original loan balance, which can help preserve more of your estate for inheritance.

However, if you stop making payments, the loan typically converts into a standard lifetime mortgage, with interest compounding over time.

Read On: The Smart Approach to Interest-Only Lifetime Mortgages

Voluntary Repayment Lifetime Mortgages

A voluntary repayment lifetime mortgage offers the flexibility to repay part of the loan or interest as and when you choose, helping to reduce the total debt over time.

Unlike traditional lifetime mortgages, which allow interest to compound, voluntary repayments can help limit costs, giving you greater control over the overall borrowing amount.

This type of plan is ideal for those who want financial flexibility while minimising the impact on their estate, as it typically has no penalties for repayments within agreed limits (but exceeding them may incur charges).

Read On: Understanding Voluntary Repayment Lifetime Mortgages

Additional Flexible Features with Lifetime Mortgages

Additional flexible features with lifetime mortgages include fixed early repayment charges, inheritance guarantees, and optional repayments.

Look out for these features when considering a lifetime mortgage product.

Consider some of these features:

- Fixed early repayment charges: Fixed early repayment charges (ERCs) provide certainty on the cost of repaying your lifetime mortgage early. Unlike variable charges, which can change over time, fixed ERCs remain consistent, allowing for better financial planning.

- Optional limited payments: If you do not want to pay off the interest every month but still want to clear some of the interest, you could settle for a product that enables you to make optional payments of up to 10% of the initial amount released per year.

- Inheritance guarantees: If you would like to protect a part of your property's value to guarantee an inheritance for your loved ones, you should choose a product that allows this, but remember that this will limit how much equity you could release.

What Is a Home Reversion Plan All About?

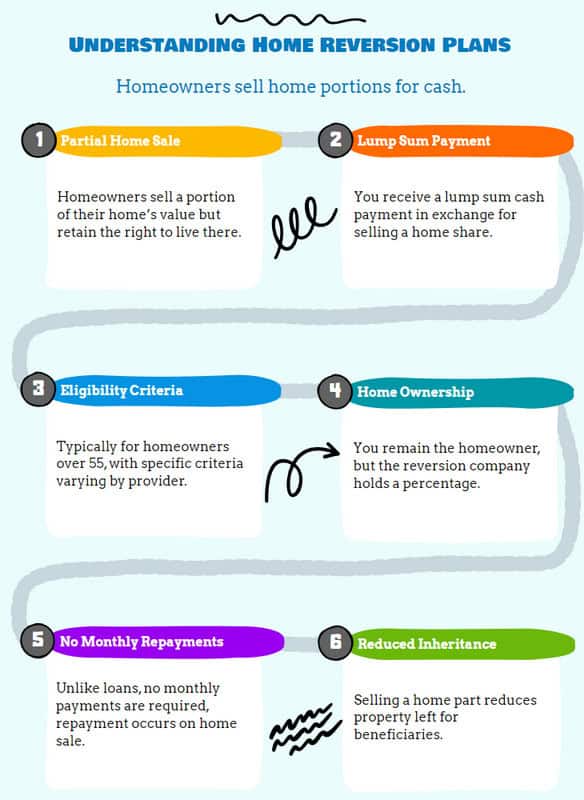

A home reversion plan is a type of equity release that is all about selling a portion or all of your property in exchange for a lump sum or regular payments while retaining the right to live in the property rent-free for the rest of your life.

The amount you receive depends on the percentage of the property sold, your age, and your health.

Take a closer look at what home reversion plans can offer:

Selling Part or All of Your Home to a Reversion Company

When selling part or all of your home to a reversion company, your property will be sold upon your passing or if you move into long-term care.

The reversion provider will receive its agreed share from the property sale, whether a portion or the full value, and any remaining value will be passed on to the beneficiaries of your estate.

While home reversion plans can offer a larger lump sum compared to other options, it's important to note that the cash you receive will likely be significantly less than your property's market value.

Tax-Free Lump Sum or Regular Payments

In exchange for a portion or all the equity locked in your house, you will receive either a tax-free lump sum or regular payments, or you could opt for a combination of both.

Continued Living in Your House

With a home reversion plan, you can continue living in your house, even though you no longer own it outright.

While the reversion company holds a share of the property, you retain the right to occupy your home for as long as you live or until you move into a residential care facility.

These plans are governed by lease agreements that ensure your right to stay in the property, either rent-free or for a nominal fee.

What Is the Best Type of Equity Release Plan for You?

The best type of equity release plan for you ultimately depends on your financial goals, property value, and long-term needs.

You'd also want to consider factors such as interest rates, repayment options, and how the plan fits with your retirement plans before choosing the best option.

Factors to consider include:

- Your Age and Health: Remember that you must typically be at least 55 to apply for a lifetime mortgage and at least 60 years for home reversion. Also, if your life expectancy is lower due to health problems or old age, you will likely qualify for more cash.

- Your Financial Goals: You can use the tax-free cash to increase your income or help to pay off existing debt.

- Your Property Value: Most providers will have a minimum property value limit, depending on the specific lender's terms.

- Your Inheritance Intentions: Equity release would decrease the value of your inheritance left to your loved ones.

- Your Long-Term Care Considerations: Your plan needs to be settled once you move into long-term care, in which case your partner probably needs to sell the property.

How Does a Lifetime Mortgage and Home Reversion Plan Differ?

A lifetime mortgage and a home reversion plan differ mainly in ownership, repayment, and how funds are accessed, with lifetime mortgages seemingly becoming more flexible and offering similar features to regular mortgages.

When you take out a lifetime mortgage, you remain the sole owner of the property as opposed to a home reversion where you could sell the whole property or part of it to the provider and will not own your house outright anymore.

Take a look at these main differences:

| Lifetime Mortgage | Home Reversion Plan | |

|---|---|---|

| You remain the sole owner of your property. | Yes | No |

| What is the maximum amount you can borrow? | It depends on your property value, age and particular lender. | It depends on your property value, age and particular lender. |

| Will your affordability be assessed? | No | No |

| Would your lender have a register charge on your property? | Yes, it is similar to a regular mortgage. | N/A since you are selling all or a part of your home to the lender. |

| Does it require mandatory monthly repayments? | No | No |

| Are voluntary payments allowed? | Yes, in most cases. | Sometimes |

| Would the interest rate be fixed? | Yes, for the lifetime of your mortgage. | N/A since you are selling all or a part of your property. |

| What is the minimum age you could apply? | 55 years | 60 years |

| What is the maximum age you could apply? | No maximum age | No maximum age |

| Do you still have the right to live in your house for the rest of your life? | Yes | Yes |

| Do you still have the option to move house if you want to? | Yes | Yes |

| Do you have downsizing protection? | Yes | No |

| Are you covered for Life Event Exemption? | Yes | No |

Common Questions

How Do Different Types of Equity Release Work?

Which Type of Equity Release Is Best for Me?

What Are the Pros and Cons of Different Types of Equity Release?

Are All Types of Equity Release Safe and Regulated?

Is Equity Release Safe?

Will Equity Release Affect My State Funded Benefits?

Is Equity Release a Good Idea?

What Is the Downside of Equity Release?

What Is the Most Common Type of Equity Release?

In Conclusion

Navigating the world of equity release types can feel overwhelming, but understanding your options is the first step toward making an informed decision.

Whether a lifetime mortgage or a home reversion plan is right for you, the key is to align your choice with your long-term financial goals.

Before taking the next step, consider speaking to an expert who can guide you through the finer details—equity release is a significant commitment, and the right advice can help you move forward with confidence.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.