- Equity release funds are commonly used for home improvements, debt consolidation, supplementing retirement income, covering care costs, and assisting family members financially, such as with home purchase deposits.

- Using equity release for home improvements can enhance property value and improve quality of life, while using it for debt consolidation can reduce monthly expenses and alleviate financial stress by paying off existing debts.

- Equity release can significantly improve a retirement lifestyle by providing additional income for travel, leisure, and other activities, with lenders generally imposing no restrictions on the use of funds but often inquiring about their intended use during the application process to ensure suitability and responsible spending.

As homeowners near or entering retirement, one question often looms large: ‘What Are the Main Equity Release Uses?’

In just the initial months of 2023, UK homeowners have already channelled an impressive £699 million from their property wealth via equity release.1

How can one make use of these funds?

In This Article, You Will Discover:

From personal enhancements to impactful gestures for family, the potential uses are diverse and tailored to individual aspirations and needs.

Our team has researched the most popular uses on the market, so take a look.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Are the Most Common Uses for Equity Release in the UK?

Equity release in the UK is most commonly used to bolster retirement income, providing an essential financial safety net for homeowners over 55 who're asset-rich but cash-poor.

Through lifetime mortgages or home reversion plans, they can access the value tied up in their home while still living there, creating a stream of income or a cash lump sum.

Another popular use is for home improvements, allowing homeowners to enhance their property's value or make it more suitable for their needs as they age.

Some also use equity release to gift a 'living inheritance' to family, helping them with significant financial milestones like buying a home or paying for education.

Learn More: Equity Release Explained

How Can Equity Release Provide a Cushion in Retirement?

Retirement brings about a shift in income sources, and for some, pensions or savings might not suffice meet unexpected expenses or to maintain the lifestyle they are accustomed to.

Equity release provides a financial cushion, offering a supplementary income stream or a lump sum.

Ultimately

This allows retirees to enjoy their golden years with more financial security, ensuring they can cover costs, indulge in luxuries, or even address larger financial goals without the constant worry of depleting their resources.

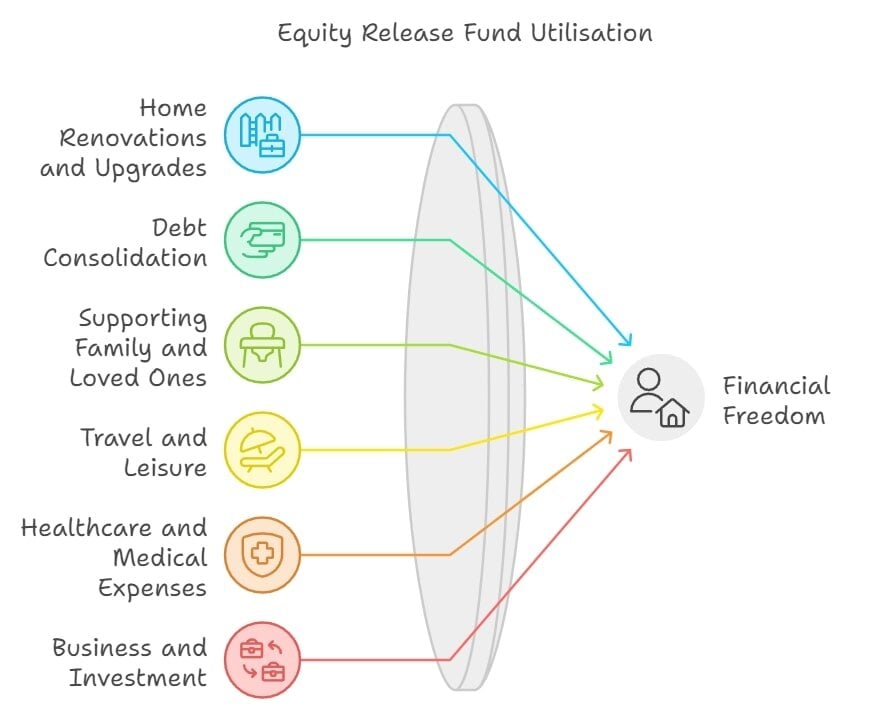

What Are the Top Uses for Equity Release Funds?

The top uses for equity release funds include home renovations, debt consolidation, supporting kin, travel, leisure and more.

Here is a detailed look.

Home Renovations and Upgrades

Your home is a place of comfort, memories, and growth. As time progresses, so do the needs of its occupants:

- Adapting homes for mobility and accessibility: Making homes more accessible as mobility needs change with age.

- Modernising interiors for increased comfort: Updating interiors to reflect modern tastes and increase comfort levels.

- Enhancing outdoor spaces, such as gardens or patios: Creating serene outdoor spaces for relaxation or entertaining.

- Investing in energy-efficient upgrades for long-term savings: Implementing energy-saving measures to reduce monthly bills.

- Addressing essential repairs to ensure safety: Fixing structural issues or other essential repairs for a safer living environment.

Debt Consolidation

Debt can be a significant stressor, especially in retirement. Consolidating debts can simplify finances:

- Paying off high-interest credit card balances: By settling these balances, homeowners can avoid accumulating interest and reduce their monthly financial commitments.

- Settling personal or car loans: Equity release can provide a lump sum to clear these loans, removing monthly repayments and possibly saving on interest.

- Clearing outstanding mortgages or other property-related debts: By doing so, homeowners can fully own their property and eliminate substantial monthly mortgage payments.

- Simplifying finances by combining multiple debts into one: This makes managing finances easier and can result in a lower overall interest rate, saving money in the long run.

Supporting Family and Loved Ones

Family is at the heart of many decisions, and equity release can be a means to offer them support:

- Contributing to children's or grandchildren's education fees: Higher education can be expensive, and equity release can ensure family members receive their desired education without financial constraints.

- Assisting with the down payment for their first home: In today's challenging property market, helping younger family members with a down payment can set them on the path to homeownership.

- Helping with wedding expenses or other significant life events: Celebrations and milestones can be costly, and equity release can ensure they are memorable without financial strain.

- Providing a financial cushion during challenging times: Whether due to unemployment, health issues, or other unforeseen circumstances, equity release can provide loved ones with the support they need.

Travel and Leisure

For many, retirement is the perfect time to explore the world and indulge in leisure activities:

- Embarking on a dream world tour: Whether exploring Europe by train or taking a safari in Africa, equity release can turn travel dreams into reality.

- Revisiting favourite places with family or friends: Whether it is a beloved holiday spot or a place filled with memories.

- Extended trips to visit family abroad: For those with family in different parts of the world, equity release can make regular, extended visits feasible.

Healthcare and Medical Expenses

Equity release can alleviate the financial strain associated with healthcare:

- Funding private medical treatments or surgeries: Ensuring timely and quality care without waiting lists or compromises.

- Covering the costs of regular therapies or medications: Whether physiotherapy sessions or essential medications.

- Investing in wellness retreats or therapeutic vacations: A chance to rejuvenate in serene environments, focusing on holistic health.

- Ensuring comfort with home care or professional caregiving services: When living independently becomes challenging.

- Adapting homes for specific medical needs: From ramps for wheelchair access to dedicated spaces for treatments, making homes more accommodating.

Business and Investment

Retirement does not mean an end to ambitions. Equity release can fuel new ventures or investment opportunities:

- Starting a new business venture in retirement: Turning a lifelong passion or a new idea into a thriving business.

- Investing in stocks, shares, or mutual funds: Diversifying financial portfolios for potential returns.

- Purchasing properties for rental income: Real estate can be a steady source of income, and equity release can facilitate property investments.

- Funding a franchise or buying into a partnership: Becoming a part of established businesses and benefiting from their success.

Lifestyle and Hobbies

Retirement is a chance to delve deeper into personal interests, and equity release can fund these pursuits:

- Enrolling in courses or workshops: From arts to new-age digital skills, learning never stops.

- Building or enhancing personal workshops or studios: A dedicated space for hobbies, painting, pottery, or music.

- Funding club memberships: Engaging in social or recreational activities, like golf clubs or book clubs.

- Purchasing luxury items: Treating oneself to luxury cars, art, or other collectables.

Charity and Philanthropy

Equity release can also serve a higher purpose:

- Donating to favoured charitable organisations: Making a difference in areas you feel strongly about.

- Setting up scholarship funds or endowments: Supporting education and opportunities for the deserving.

- Supporting community projects: Contributing to local causes, from parks to cultural initiatives.

- Sponsoring events or activities: Promoting arts, culture, or youth programs.

Emergency Funds

Life is unpredictable. Equity release can provide a safety net:

- Keeping a reserve for unexpected expenses: From home repairs to medical emergencies.

- Covering costs during family emergencies: Ensuring one can always support loved ones.

- Being prepared for sudden large expenditures: Replacing essential items or addressing unforeseen challenges.

- Ensuring liquidity during economic downturns: Providing stability during uncertain times.

Estate Planning and Legacy

Leaving behind a legacy is a consideration for many:

- Pre-paying funeral expenses: Easing the burden on loved ones during challenging times.

- Creating trusts or funds: Ensuring descendants are taken care of.

- Investing in assets to pass down: Be it properties, jewellery, or art.

- Covering estate management costs: Ensuring a smooth transition of assets and fulfilling last wishes.

Prohibited Uses of Equity Release Funds

To safeguard both the lenders and the borrowers, there are restrictions on how these funds can be used.

Here is a look at some common prohibitions set by providers:2

- Illegal Activities: Beyond overtly illegal activities, this may also encompass funding operations that do not have necessary permissions or licenses. For example, unauthorised building extensions or renovations that go against local council regulations.

- Speculative Investments: Engaging in high-risk trading or gambling activities and investing in ventures without proper due diligence is prohibited.

- Business Bailouts: This is especially risky if the business in question has been consistently underperforming or if it is in an industry facing a significant downturn. Providers want to ensure that the equity released does not end up in ventures with a high chance of loss.

- Foreign Property Purchases: Some providers might restrict the use of funds for buying property abroad due to the complexities and risks associated with foreign real estate.

- Gifting Large Amounts Without Proper Planning: Significant gifts can have inheritance tax implications. If not done correctly, recipients might get a hefty tax bill. This ensures that borrowers do not deplete their equity for the sake of others, leaving themselves in financial hardship.

- Purchasing Uninsurable Assets: This could include certain rare collectables, exotic pets, or assets in areas prone to natural disasters. The inability to insure these assets means their value can be wiped out, and the borrower might be left with no way to recover their investment.

Common Questions

What Are the Most Common Uses for Equity Release?

How Can Equity Release Be Used in Retirement Planning?

Can Equity Release Be Used to Pay Off Debts?

What Are the Risks and Benefits of Using Equity Release?

How Can Equity Release Be Used to Fund Home Improvements?

Is There a Cap on How Much I Can Release?

If I Opt for Equity Release, Who Holds the Property Title?

What Happens If the Housing Market Faces a Downturn?

Are There Penalties for Settling Equity Release Early?

Is Relocating an Option After Equity Release?

Will My Decision Impact the Legacy I Leave Behind?

Conclusion

Equity release’s applications range from lifestyle enhancement to addressing unforeseen financial challenges.

While it offers immediate financial benefits, potential borrowers should consider its long-term implications, particularly on inheritance.

Proper consultation and informed decision-making are essential to maximise the benefits of this financial tool.

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.