- Equity release might let you owe more than your home's worth, thanks to compound interest, but you can shield and protect a percentage of your home's value, and you can choose how you cash out—in lump sums or smaller amounts, both of which are tax-free.

- Common myths are that you'll lose your home or that it's the only retirement financial strategy, but these are not true.

- These plans offer flexibility with zero required monthly paybacks, with interest accruing only upon the property's sale or the homeowner's death.

What are the 4 little-known truths about equity release?

As July 2023 statistics show, the average UK house price has surged to £290,000, reflecting a £2,000 increase from a year prior.1

This uptick in home values might make equity release appear enticing to older homeowners.

However, to make an informed choice, it is vital to sift through the myths, grasp the essence of equity release, and understand its broader implications.

In This Article, You Will Discover:

At BankingTimes, our team taps into a myriad of credible sources, and then we verify, refine, and ensure the integrity of our content, making it current and pertinent.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

What Are the Little Known Facts About Equity Release?

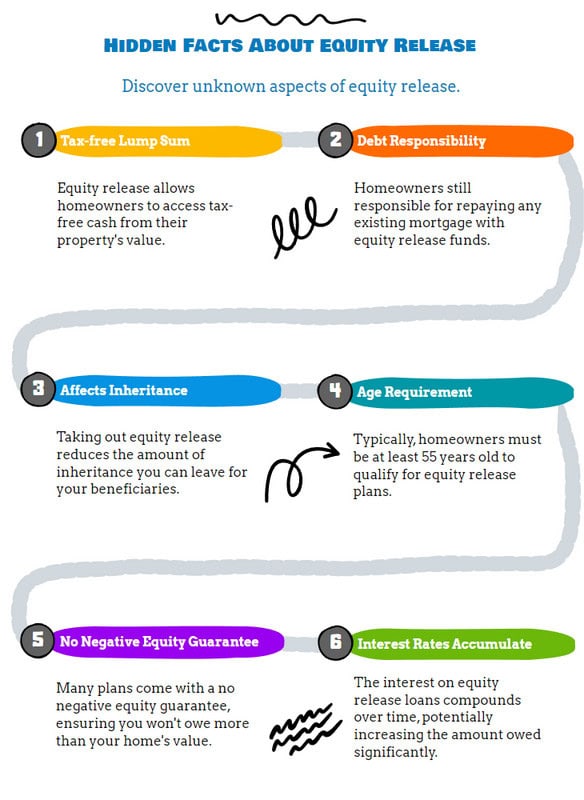

Equity release can often be a misunderstood financial product, but we're here to provide insights into its lesser-known aspects.

Contrary to popular belief, you don't have to be retired to access an equity release.

Also, did you know you can make voluntary repayments with some plans, reducing the overall cost of the loan?

Another interesting point about equity release is that it's not a one-size-fits-all solution.

There are various types to choose from, such as lifetime mortgages and home reversion plans.

You also might not realise that releasing equity from your property doesn't necessarily mean you can't move home in the future.

1. The Facts About Equity Release: Are There Drawbacks?

Understanding the complexities of equity release, including interest rates, impact on your estate's value, and options for relocation or early repayment, can shed light on its possible drawbacks.

Equity Release Rates: Are They Fixed or Variable?

Interest rates on equity release plans are typically fixed, although some providers may offer variable rates.

In accordance with Equity Release Council standards the interest rate should either remain fixed for each release or, if variable, it must be subject to a lifetime cap throughout the loan term.2

It is essential to note that interest rates can differ between providers, so thorough research is advisable.

How Does Equity Release Affect Your Estate and Inheritance?

Releasing equity can decrease the value of your estate and subsequently, the inheritance you leave behind.

Typically, when you die or go into long-term care, your home is sold to settle the loan and interest, resulting in a decrease in your estate's value and potentially reducing the inheritance available to your beneficiaries.

However, there are a couple of safeguards to preserve some of the value of your estate.

These are:

- Inheritance Protection Guarantee: Allows you to set aside a portion of the value of your home for your heirs.

- No Negative Equity Guarantee: Ensures your debt does not exceed the value of your property, so your estate will not be liable for any shortfall.

Be sure to discuss the effects of your plan on your estate and inheritance with your advisor before proceeding.

Can I Move House With Equity Release?

Yes, most providers allow you to transfer your plan to a new property, if it meets their criteria.3

However, if your new home is valued less than your previous property, you may be required to repay some of the loan from the proceeds of the sale.

If you know that a move may be on the cards when you take out your plan, discuss the implications of transferring it with your financial advisor or provider.

Is Early Repayment of Equity Release An Option?

Yes, early repayment of your plan may be an option, though you could incur penalties in the form of early repayment charges (ERCs).

Your plan is designed to be a long-term loan, so if you want to settle before the term ends, your provider is going to want to recoup any losses, but this is largely dependent on your agreement.

Your ERCs are usually calculated as a percentage of your loan amount, or they will be linked to the price of gilt bonds if you have a variable rate.4

They may also fall away after a predetermined period within your loan, subject to the terms of your individual plan.

Again, this is something you need to discuss with your financial advisor.

2. The Truth About Equity Release: Does It Live Up to Its Promise

Gaining clarity on this type of loan, particularly around the costs and how your plan can reduce your financial standing, can ensure you know whether it meets its promises.

How Much Does Equity Release Really Cost?

The actual costs consist of both your setup fees and the interest rate.

Setup fees encompass expenses like an arrangement fee, home valuation costs, advice fees, and solicitor's fees.

Some providers may offer concessions on some of these as part of your agreement.

Here is a top tip

To prevent interest from accruing, you can choose to make voluntary repayments, typically limited to 10% of your loan's value annually.5

This strategy can significantly reduce the ultimate amount owed at the end of your loan term.

Are There Any Hidden Charges?

There should not be any hidden charges because Equity Release Council guidelines state that communication with clients must be transparent, and they must fully understand the cost implications of taking out a plan.6

Ensure that you have a complete understanding of the costs, and if you have any doubts, consult with your financial advisor.

How Does Equity Release Impact Your Financial Standing?

Releasing equity can impact your financial standing because you have reduced the value of your biggest fixed asset.

It is important that you weigh up the quick fix of cash-in-hand against the potential long-term losses.

3. Debunking Myths: What Are Some Fallacies About Equity Release?

There are myths aplenty surrounding equity release, raising questions about home ownership, whether it is a debt trap, the types of plans available, and how it will affect your eligibility for benefits.

Can I Lose My Home With Equity Release?

No, you will not lose your house, as retaining ownership without the need to make repayments is one of the fundamentals of these loans.

Only in extreme circumstances, where you are in breach of your contract, would the provider possibly consider repossessing your property.

Is Equity Release a Debt Trap?

With adequate planning, it need not become a debt trap, although it does result in an increase in your debt.

Compound interest can contribute to this debt growth, highlighting the importance of discussing strategies to manage it with your advisor.

In March 2022, the Equity Release Council introduced a new protection mechanism allowing partial payments without penalties on new lifetime mortgages, enhancing repayment flexibility and debt management options.7

Are There Different Types of Equity Release Plans?

Yes, there are two types, namely lifetime mortgages and home reversion plans.

With lifetime mortgages, you retain ownership and access the equity in your home, settling the debt and interest when the property is sold.

With home reversion plans, you sell a portion or the entirety of your home, get a lump sum payment or regular ones, and continue living there without paying rent.

Different providers offer varying terms, rates, and charges so it is best to consult an expert to determine the most suitable plan for you.

Can Equity Release Affect My Eligibility For Benefits?

Yes, releasing equity can impact your means-tested benefits.

Accessing your home equity could push your savings or income beyond government thresholds, potentially reducing or even disqualifying you from benefits like Pension Credit or Council Tax Reduction.8

4. Looking Ahead: Things to Consider Before Deciding on Equity Release?

Before accessing your home's value, it is vital to explore alternatives and seek guidance from a qualified advisor to make a well-informed decision.

How Do You Get Ready for Equity Release?

Familiarise yourself with terms, evaluate your needs, and understand potential outcomes.

Examining various plans, obtaining unbiased guidance, sharing intentions with relatives, and pondering the effects on inheritance, entitlements, and upcoming monetary requirements are key actions in this journey.

Are There Other Options Besides Equity Release?

Yes, there are alternatives worth considering, such as downsizing, renting out a room, or taking out a personal loan to name a few.

Bear in mind all these alternatives come with their own set of pros and cons, so it is important you talk to an expert to work out the best option for you.

How Can a Financial Advisor Help Me With Equity Release?

A financial advisor offers tailored advice, ensuring your plan aligns with your financial goals.

They evaluate appropriateness, clarify plan variations, expenses, influence on your assets, and implications for means-tested benefits.

Advisors assess plans from various providers, emphasise potential risks, and propose alternative options to assist you in making an informed decision.

Read More: Reasons for Choosing Equity Release

Common Questions

What Are the Hidden Facts About Equity Release?

What Are the Misconceptions About Equity Release?

What Are the Lesser Known Benefits of Equity Release?

Are There Any Unexpected Risks in Equity Release?

What Are Some Uncommon Details About Equity Release That I Should Know?

What is the Basic Principle Behind Equity Release?

Who is Eligible for an Equity Release?

How Does Equity Release Differ from a Regular Mortgage?

Do I Still Own My Property After Taking Equity Release?

What are the Tax Implications?

Conclusion

Equity release, while beneficial for many, is surrounded by myths and misconceptions.

It is paramount that individuals venture beyond surface knowledge and familiarise themselves with the intricacies of this financial avenue to make more informed decisions.

So, when pondering this option, always come back to the question: What are the four little-known truths about equity release?

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.