- Basic eligibility for equity release typically requires homeowners to be at least 55 years old and own a property that meets the lender’s minimum value and condition criteria.

- While homeowners with existing mortgages can qualify, they must use the equity released to fully pay off the existing mortgage as a condition of the agreement.

- Potential disqualifiers for equity release include owning a property in poor condition, having a property value below the lender’s required threshold, or carrying outstanding debts that exceed what the equity release can cover—it's best to consult with a financial adviser.

Exploring who qualifies for equity release has become a pivotal question for many in the UK.

Recent data shows that the equity release market has surged, with homeowners aged 55 and over unlocking an astounding £716 million in the 3rd quarter of 2023.1

This comprehensive guide delves into the nuances of equity release eligibility, offering essential insights for those considering this significant financial step.

In This Article, You Will Discover:

Our financial experts at BankingTimes have crafted a detailed exploration of the criteria for equity release, typically focused on UK homeowners.

Join us as we unravel the criteria, demystify the process, and illuminate the path to accessing your home's value.

Request a FREE call back discover:

- Who offers the LOWEST rates available on the market.

- Who offers the HIGHEST release amount.

- If you qualify for equity release.

Understanding Equity Release Eligibility

Equity release can be a useful option for older homeowners who need extra income or want to fund a specific expense, such as home improvements, a holiday, or a gift for their family.

However, it is not suitable for everyone, and there are certain eligibility criteria that you need to meet before you can apply.

What Are the Basic Qualification Criteria?

Eligibility hinges on several key factors relating to your age and the property.

The basic qualification criteria for equity release are:

- You must be at least 55 years old for a lifetime mortgage, or 60 years old for a home reversion plan.

- You must own a property in the UK that is worth at least £70,000. This is the minimum value that most equity release providers will accept, although some may have higher or lower thresholds depending on the type and location of your property.

- You must live in the property as your main residence.

How Does Age Affect Eligibility?

Your age is one of the most important factors that affect your eligibility for equity release, the amount of money you can release, and the interest rate you will pay.

Generally speaking, the older you are, the more equity you can release from your home, and the lower the interest rate you will pay.2 This is because the provider will expect to get their money back sooner, and therefore take less risk.

The minimum age for equity release is 55 for a lifetime mortgage and 60 for a home reversion plan, but some providers may have higher age limits.3

Although there is no universal upper age limit for equity release, certain providers may have their own specific age caps.

Is Homeownership Essential for Eligibility?

Yes, you must own your home outright or have a small mortgage to qualify for equity release.

If you have a mortgage or any other loan secured against your property, you will need to pay it off either before or at the same time as taking out equity release.

This will reduce the amount of equity you can release from your home and may affect your eligibility for certain schemes.

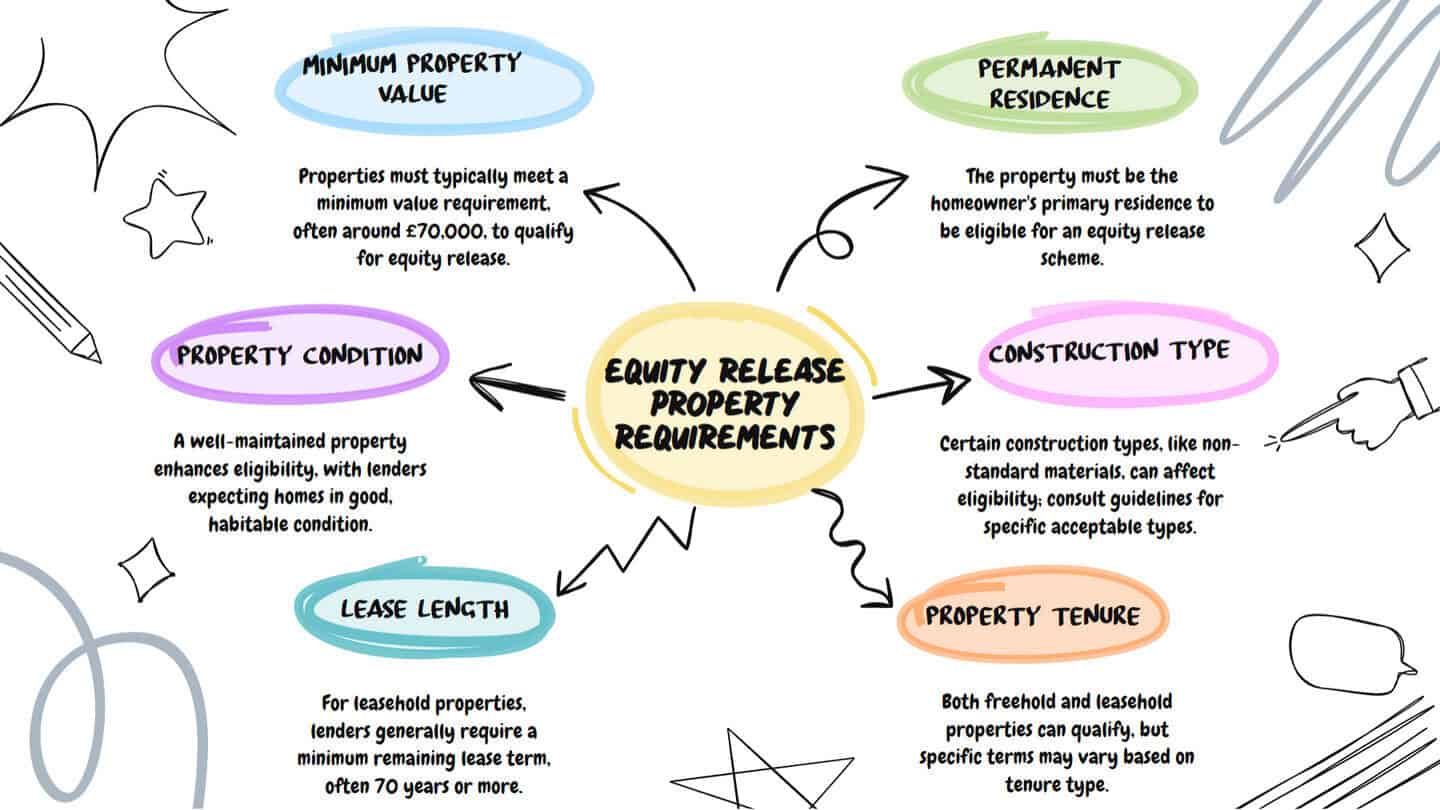

Property Requirements for Equity Release

The type and condition of your property are crucial in determining eligibility and the amount that can be unlocked.

Which Types of Properties Qualify?

Providers typically favor standard construction homes, including detached, semi-detached, and terraced houses, as well as flats or apartments in purpose-built blocks. They often extend eligibility to bungalows, maisonettes, or cottages, provided these meet their specific criteria.

However, certain property types are generally excluded due to being non-standard, high-maintenance, or high-risk, which complicates valuation and sale. These include homes with thatched roofs, timber frames, flat roofs, or those featuring conservatories, extensions, or annexes.

Flexibility varies among providers and some may consider these non-standard properties on an individual basis, evaluating factors such as condition, location, and marketability.

If you have doubts about your property's eligibility, it is advisable to seek guidance from an equity release specialist who can provide tailored advice.

Why Do Property Value and Condition Matter?

The value and condition of your property directly impact your eligibility, the amount you can access, and the interest rate. Higher property values and better maintenance typically allow for more equity release at lower interest rates.

Minimum property values usually start at £70,000, with maximum values around £1 million, although these can vary by provider and property type.

A surveyor assesses your property's condition, and any necessary repairs could affect the plan’s terms or even lead to application rejection if the property is deemed unsuitable.

Does the Location of the Property Affect Eligibility?

Yes, your property's location plays a role in your eligibility, influencing both the amount you can release and the interest rate.

Properties in desirable, accessible locations typically qualify for more favorable terms, as they are easier and quicker for providers to sell, posing less risk.

The assessment often revolves around the property's postcode, reflecting its proximity to urban centers, transport links, and amenities.

Providers might also consider local property demand and supply, average house prices, rental yields, and area-specific factors like crime and unemployment rates.

Special Property Considerations

Certain types of properties require additional consideration due to their unique characteristics. These properties may not align with the standard criteria of most providers, necessitating a more in-depth evaluation.

Can Leasehold and Ex-Local Authority Properties Qualify?

Properties with leasehold terms or those previously under local authority ownership often come under special scrutiny.

Here is how they are typically assessed:

- Leasehold Properties: They can qualify, but the lease term is crucial. Most providers require a significant remaining lease duration, often at least 70-80 years, to consider the property.4

- Ex-Local Authority Properties: These properties are also eligible, but their valuation might be affected by factors such as location, condition, and demand. Some lenders may be hesitant if the property is in a high-rise block or part of a large estate.5

Are There Exceptions for Certain Property Types?

The eligibility of properties with non-standard features or locations can vary significantly among equity release providers.

Here are some common considerations:

- Non-Standard Construction: Properties with unconventional construction (like timber or thatched roofs) are assessed on a case-by-case basis. Their eligibility depends on the property's condition, maintenance, and marketability.

- Properties with Unique Features: Homes with unique attributes, such as eco-friendly installations or historical significance, may require special valuation. Their eligibility often hinges on how these features impact the property's market value and saleability.

- Rural or Remote Properties: Homes in remote or rural areas might face scrutiny regarding their accessibility and demand in the housing market. Providers assess these properties for potential challenges in resale.

In each case, the provider's main concern is the property's marketability and the ease with which it can be sold if necessary.

Homeowners with such properties should be prepared for a more involved assessment process and may benefit from seeking advice from equity release specialists who have experience with unique property types.

Financial Aspects of Equity Release Eligibility

Your financial background and existing mortgages are important factors in the eligibility process.

How Do Existing Mortgages Impact Eligibility?

If you have an existing mortgage or any other loan secured against your property, you will need to pay it off either before or at the same time as releasing equity.

This will reduce the amount of equity you can release from your home and may affect your eligibility for certain schemes.

Most equity release providers will require you to have at least 30% to 50% equity in your home, depending on your age and the type of scheme you choose. For example, if your home is worth £200,000 and you have a mortgage of £50,000, you have 75% equity in your home (£150,000). This means you may be able to release up to £75,000 (50% of your equity) through equity release, depending on your age and other factors.

* This is for indicative purposes only.

Does Credit History Influence Equity Release Options?

No, your credit history generally does not affect your eligibility for unlocking home equity, as long as there are no outstanding debts on your property.

This process is based on your property's value and condition rather than your income or repayment ability.

Unlike standard mortgages, it does not necessitate monthly repayments; instead, the interest is rolled into the loan, which is settled when you pass away, move into permanent care, or sell your home.

Therefore, providers typically do not focus on your credit score but will require documentation to verify your identity, address, and property ownership

Read On: Can You Still Get Equity Release With Bad Credit?

Personal Factors Affecting Equity Release

Your personal circumstances play a significant role in determining the suitability and specific terms of your plan for unlocking home equity.

These factors go beyond just the financial aspects and delve into the nuances of your individual situation.

Does Marital Status Affect Equity Release?

Yes, your marital status can affect your equity release, as it can affect the ownership and inheritance of your property.

If you are married or in a civil partnership, you will need to apply for equity release jointly with your spouse or partner, as they have a legal right to your property. This means that both of you will need to meet the eligibility criteria, and both of you will need to sign the equity release agreement.

If you are divorced or separated, you will need to ensure that your property is solely in your name, or that you have the consent of your ex-spouse or ex-partner to release equity from your home. This means that you may need to provide proof of divorce or separation, or a written statement from your ex-spouse or ex-partner, to confirm that they have no claim to your property.

If you are single, widowed, or cohabiting, you will need to decide whether you want to apply for equity release alone or with someone else, such as a family member or a friend. This means that you will need to consider the implications of sharing the ownership and the inheritance of your property, and the impact of equity release on your tax and benefits.

What Is the Impact of Joint Ownership?

If you apply for equity release with someone else, such as your spouse, partner, relative, or friend, you will need to consider the impact of joint ownership on your equity release.

This includes:

- Release Amount: The sum you can unlock from your home is influenced by the age and health of the youngest applicant. Younger or healthier co-applicants might mean accessing a lesser amount compared to applying solo, as they are expected to have a longer lifespan, delaying repayment.

- Interest Rate: The rate applied to your plan will vary based on the chosen provider and scheme, as well as current market trends. Joint applications could result in either more favorable or less advantageous rates, depending on the available options and market conditions.

- Inheritance Impact: Joint ownership affects the inheritance left to beneficiaries. The total amount owed (including accumulated interest) is repaid when the last surviving owner either passes away or moves into permanent care. Therefore, the amount of inheritance left will depend on how much equity is used and the property's value at that time. Joint owners need to consider how this will impact the amount of estate left to their heirs.

In essence, joint applications for equity release require careful evaluation of these factors to understand how they collectively influence the financial outcome of the plan.

How Are Health and Life Expectancy Considered?

Your health and life expectancy are also considered by some providers, as they can affect the amount of money you can release and the interest rate you will pay.

This is because the provider will estimate how long you will live and therefore how long they will wait to get their money back.

Enhanced or impaired schemes are designed for homeowners who have a lower life expectancy due to a medical condition or a lifestyle factor.

These schemes allow you to release more money from your home, or pay a lower interest rate, than standard schemes, as the provider will expect to get their money back sooner.

Some of the medical conditions or lifestyle factors that may qualify you for an enhanced or impaired scheme are:

- Cancer

- Diabetes

- Heart disease

- Stroke

- High blood pressure

- High cholesterol

- Smoking

- Obesity

- Parkinson’s disease

- Alzheimer’s disease

- Multiple sclerosis

- Arthritis

- Asthma

- COPD

To apply for an enhanced or impaired scheme, you will need to complete a health and lifestyle questionnaire and provide evidence of your medical condition or lifestyle factor, such as a doctor’s letter, a prescription, or a test result.

The provider will then assess your eligibility and offer you a personalised quote based on your health and life expectancy.

Common Questions

What Are the Eligibility Criteria for Equity Release?

How Do I Know If I Qualify for Equity Release?

Can Anyone Over 65 Qualify for Equity Release in the UK?

What Factors Determine If You Qualify for Equity Release?

Is There an Income Requirement to Qualify for Equity Release?

Are There Age Limits for Equity Release?

Can Equity Be Released from a Property with an Outstanding Mortgage?

What Happens After Releasing Equity if Circumstances Change?

Are There Eligibility Differences Between Lifetime Mortgages and Home Reversion Plans?

Can Non-UK Residents or Expatriates Qualify for Equity Release in the UK?

How Does Having Dependents Living in the Property Affect Eligibility?

Conclusion

Equity release is a flexible financial option that can help homeowners access the value tied up in their properties.

Understanding the various eligibility criteria, property requirements, financial considerations, and personal factors is crucial when exploring this avenue.

Whether you are married or single, in good health or facing health challenges, or own a standard or unique property, there are equity release options available.

To make an informed decision about whether it is the right choice for you, consider seeking advice from a qualified specialist.

Ultimately, when assessing who qualifies for equity release, it is important to weigh the potential benefits and obligations to ensure this form of borrowing aligns with your financial goals and future plans.

Read More: Is Releasing Equity the Right Choice?

WAIT! Before You Go...

How Much Could You Unlock?

Found an Error? Please report it here.